Thursday, January 27, 2011

The week that changed the Arab World forever

History is being written in the streets of the Arab world this week. What implications will it have for the wider world?

History is being written in the streets of the Arab world this week. What implications will it have for the wider world?What if the Muslim Brotherhood seized power in Egypt? What would that mean for Israel and Gaza? What would it mean for the passage of western shipping transiting the Suez. Would the US and Western European Navies be still allowed to pass freely? Could we see another Suez Crisis, and if so what would that mean for the price of oil & gold? Only time will tell, these are certainly interesting times.

See the protests in photos

** Update **

Yemen protesters demand change of government

Thousands inspired by unrest that ousted Tunisian leader and spread to Egypt gather in Sana’a to call for new political era

http://www.guardian.co.uk/world/2011/jan/27/yemen-protesters-demand-change-government

Made in the USA

Big Algerian Wheat Purchase Spooks Traders

Just another example of what happens when governments around the world create trillions of dollars worth of fiat currency out of thin air. That money is used to buy commodities that have intrinsic value such as wheat, rice, gold and silver; ie those items that cannot be created by adding zeros to a bank balance sheet.

Just another example of what happens when governments around the world create trillions of dollars worth of fiat currency out of thin air. That money is used to buy commodities that have intrinsic value such as wheat, rice, gold and silver; ie those items that cannot be created by adding zeros to a bank balance sheet.By TOM POLANSEK

Wall St Journal

U.S. wheat futures surged to fresh 29-month highs Wednesday as growing concern over food prices drove Algeria to make another large grain purchase on the world market.

Algeria sparked Wednesday's rally by buying 800,000 metric tons of milling wheat, with traders estimating the deal brings the African nation's total purchases for January to about 1.8 million tons. The source of Algeria's latest purchase wasn't disclosed.

Government buyers across North Africa and the Middle East have stepped up wheat purchases in recent weeks following unrest in Tunisia, Jordan and Egypt. Rising food prices are helping to drive the discontent in those countries.....read in full

Nouriel Roubini: Rise in food and commodity prices a risk to stability

(CNN) -- Rapidly rising oil, energy and food prices pose a serious threat to global stability, leading U.S. economist Nouriel Roubini has warned.

(CNN) -- Rapidly rising oil, energy and food prices pose a serious threat to global stability, leading U.S. economist Nouriel Roubini has warned.Speaking at the World Economic Forum's 2011 annual meeting in Davos, Switzerland, Roubini said the global economy was a "glass half-full and a glass half-empty", with some signs of recovery.

But he told CNNMoney.com there were still "many things that could go wrong" in the coming year.

Asked to pick what he considered the biggest new threat, Roubini -- who earned himself the nickname "Dr Doom" for his pessimistic predictions during the economic crisis -- highlighted the large increase in commodity prices.

He said the rapid rise "could be a source of political instability, not only economic and financial fragility."

"What has happened in Tunisia and is happening right now in Egypt, but also the riots in Morocco, Algeria, Pakistan are related not only to high unemployment rates and to income and wealth inequality, but also to the very sharp rise in food and commodity prices.".....read on

Commodities - US Global Investors' 2011 outlook

SAN ANTONIO (U.S. Global Investors) -

The essence of natural resources and commodity investing can be boiled down to one key point:

As the earth's population swells to 7 billion, the migration to cities accelerates, incomes rise, and people desire things the things that improve their lives, thus increasing global demand for commodities and natural resources.

A larger, wealthier class of people in the emerging world are demanding more goods as they raise their standard of living and the supply of these goods is impacted by geopolitics, diminishing mature sources and even weather.

The story begins in emerging markets where economies are growing at stable, healthy rates. Current growth rates for countries such as China, India, Malaysia and others are in the 6-10 percent range, manageable levels that are not characteristic of overheating economies. Many forecasters are expecting a slight slowdown in growth for emerging countries but a few (South Africa, Indonesia and Russia) should see GDP growth rates surpass last year's levels.

Many point to China's bank lending, which was roughly $1.2 trillion last year, as a negative because it is such a large amount for a $5 trillion economy, but we don't see it that way. We think what's taking place is more of a normalization of liquidity and interest rates. Growth will still be in the upper single digits, which is very constructive for commodity demand going forward.

Economic growth is just the tip of the iceberg. Many of these emerging markets are just discovering credit. India, China, Brazil and Russia all have consumer debt levels growth below 20 percent. Other burgeoning countries like Saudi Arabia and South Africa have less than 5 percent. As credit expands to this hungry consumer base, the consumption of refrigerators, furniture, air conditioners and other luxuries we consider necessities here in the U.S. should follow suit.

We've already seen the impact rising income levels can have on consumption in Chinese car sales. From 2003 to 2010, China's car sales have increased over 300 percent. In fact, car sales jumped 45 percent last year alone in China. This increase has made China the global leader in car sales. China isn't alone however, estimates show that 72 million cars were produced globally last year and expectations are that it will jump to 79 million in 2011.

This auto boom has shifted the dynamics of energy consumption in the developing world. The transportation sector has historically consumed about 35 percent of all energy used in the developing world. But over the next 15 years or so, it's expected to reach about 60 percent-comparable levels to that of the developed countries of North America and Western Europe.

Emerging market demand is largely the reason global oil demand levels are at record highs despite a sluggish economic recovery in the U.S. and Western Europe. Much of this demand comes from China and India, whose combined share of global oil demand has increased from 9 percent in 2002 to roughly 15 percent last year.

But it's not just oil emerging markets have been gobbling up. It takes a lot of base metals such as copper, tin, nickel and others to expand a nation's power grid, sewer system and transportation lines. China's most recent Five-Year Plan calls for $50 billion to be spent on upgrading the country's power grid and an another $110 billion on building 13,000 kilometers of high-speed railways.

This is a reason why we've seen the price of copper, lead, tin, nickel and zinc jump more than 100 percent during the past two years.

The market isn't expecting prices for these metals to turn around any time soon. Take copper for example. Current prices are north of $4 a pound but the futures market remains bullish with prices set around $5.43 a pound.

Copper's supply/demand fundamentals are very supportive of higher prices. Mine production has been declining since the early 1990s but the metal's versatility has kept copper demand on the rise.

For instance, you may not think that air conditioning demand would have much to do with copper prices but each central air conditioning unit contains roughly 50 pounds of copper. The monthly output of air conditioners in China has increased since the beginning of 2009, coinciding with a 217 percent increase in copper prices.

Copper isn't alone. We're bullish on many industrial commodities for similar reasons. As the rebound in global economic growth continues, we should see increased demand for other commodities like metallurgical coal, which is used to make steel.

The biggest threat to commodity prices is the possibility that the Federal Reserve may begin to raise interest rates, which would weigh on commodity prices. More than likely however, the Federal Reserve will maintain historically low interest rates and the U.S. economic recovery will remain on course through the year.

Frank Holmes, Evan Smith and Brian Hicks are the co-managers of the U.S. Global Investors Global Resources Fund (PSPFX) U.S. Global Investors

The Great Debt Shift

Two of the world's largest economies, the EU ($16 trillion) and the US ($14 trillion), have become the leading practitioners of private-to-public debt shifting. The US has assumed the debts of banks, insurers, mortgage holders, and even entire industrial sectors. The European Union has done the same for entire states. The resulting public debt levels are, predictably, placing strains on both the dollar and the euro.

Worse still, the bailouts have created a spirit of apathy toward debt accumulation. Western governments have embarked on a debt binge for the ages. Already, the credit ratings of the United States and some of the EU's core countries, such as France and the UK, are being questioned.

While this socialization of private debt has created deep citizen resentment, it remains to be seen whether political pressure is enough to hold back the tide. In the US, the forces of fiscal restraint appear to have the upper hand at present; but, this late in the game, it is far from certain that the newly elected fiscal hawks will be able to avert civil unrest and debt default.

It is worth noting that the debt shift has offered some near-term benefits. Relieved of repayment anxiety, many companies have posted very promising earnings reports in recent months (one needs to only glance at Detroit). Despite continued demand weakness, these companies have worked hard to improve their balance sheets and raise operating margins. The resulting rally in share prices has given rise to a belief that recovery is at hand.

However, despite buoyant share prices, unemployment continues at dangerously high levels, depressing tax revenues and leading to much greater entitlement spending. This has made public debt levels rise even faster.

Total world direct sovereign debt, excluding guarantees and unfunded medical and pension obligations, is some $41.6 trillion dollars. When the $2.9 trillion owed by global municipalities is included, total direct public sector debt is over $50 trillion. Against this total, even the wealth of cash-rich nations such as China ($2.85 trillion in foreign-exchange reserves) and Japan ($1.1 trillion in reserves) pale into insignificance.

With so little credit to soak up the future financing needs of the US and the EU, it is no wonder that both their currencies are coming under pressure. It should be no surprise that Chinese President Hu began his state visit to the US by warning that the debased dollar was causing much of the world's monetary problems - and was thus no longer credible as the world's reserve. Once unshielded by that great privilege, I forecast that the US dollar will plummet.

In many ways, the euro may fare little better. The EU has organized a $1 trillion rescue package for its smaller members, but, in practice, there is not enough money for all the troubled peripherals, let alone a core state like France or Spain. Last week, the EU suggested that Greece should be allowed to default and restructure much of its debt. The Irish Times reported that the EU has allowed Ireland to print its own euros to settle the debts of its banks. Will it allow Portugal, Spain, Belgium, Italy and France to do the same? If so, what credibility will remain for the euro?

Possible because a major currency collapse is unprecedented in living memory, investors have been slow to react. While the markets are calm at present, we mustn't forget that the nature of panic is that it is sudden. It can erupt quickly and overwhelm the unprepared. When it does, even supposedly rock-solid assets like Treasury bonds may be discounted severely.

In such a climate, gold and silver are as faithful as Old Yeller.

John Browne is the Senior Market Strategist for Euro Pacific Capital, Inc. Mr. Brown is a distinguished former member of Britain's Parliament who served on the Treasury Select Committee, as Chairman of the Conservative Small Business Committee, and as a close associate of then-Prime Minister Margaret Thatcher. Among his many notable assignments, John served as a principal advisor to Mrs. Thatcher's government on issues related to the Soviet Union, and was the first to convince Thatcher of the growing stature of then Agriculture Minister Mikhail Gorbachev. As a partial result of Brown's advocacy, Thatcher famously pronounced that Gorbachev was a man the West "could do business with." A graduate of the Royal Military Academy Sandhurst, Britain's version of West Point and retired British army major, John served as a pilot, parachutist, and communications specialist in the elite Grenadiers of the Royal Guard. In addition to careers in British politics and the military, John has a significant background, spanning some 37 years, in finance and business. After graduating from the Harvard Business School, John joined the New York firm of Morgan Stanley & Co as an investment banker. He has also worked with such firms as Barclays Bank and Citigroup. During his career he has served on the boards of numerous banks and international corporations, with a special interest in venture capital. He is a frequent guest on CNBC's Kudlow & Co. and the former editor of NewsMax Media's Financial Intelligence Report and Moneynews.com. He holds FINRA series 7 & 63 licenses. More importantly take action to protect your wealth and preserve your purchasing power before it’s too late. Discover the best way to buy gold at www.goldyoucanfold.com, download my free research report on the powerful case for investing in foreign equities available at www.researchreportone.com, and subscribe to my free, on-line investment newsletter.

John Browne is the Senior Market Strategist for Euro Pacific Capital, Inc. Mr. Brown is a distinguished former member of Britain's Parliament who served on the Treasury Select Committee, as Chairman of the Conservative Small Business Committee, and as a close associate of then-Prime Minister Margaret Thatcher. Among his many notable assignments, John served as a principal advisor to Mrs. Thatcher's government on issues related to the Soviet Union, and was the first to convince Thatcher of the growing stature of then Agriculture Minister Mikhail Gorbachev. As a partial result of Brown's advocacy, Thatcher famously pronounced that Gorbachev was a man the West "could do business with." A graduate of the Royal Military Academy Sandhurst, Britain's version of West Point and retired British army major, John served as a pilot, parachutist, and communications specialist in the elite Grenadiers of the Royal Guard. In addition to careers in British politics and the military, John has a significant background, spanning some 37 years, in finance and business. After graduating from the Harvard Business School, John joined the New York firm of Morgan Stanley & Co as an investment banker. He has also worked with such firms as Barclays Bank and Citigroup. During his career he has served on the boards of numerous banks and international corporations, with a special interest in venture capital. He is a frequent guest on CNBC's Kudlow & Co. and the former editor of NewsMax Media's Financial Intelligence Report and Moneynews.com. He holds FINRA series 7 & 63 licenses. More importantly take action to protect your wealth and preserve your purchasing power before it’s too late. Discover the best way to buy gold at www.goldyoucanfold.com, download my free research report on the powerful case for investing in foreign equities available at www.researchreportone.com, and subscribe to my free, on-line investment newsletter.

A Word You Should Know: "Stagflation"

By Anthony Migchels

By Anthony Migchels(for henrymakow.com)

Since the start of the Credit Crunch in Sept. 2008, a fierce debate has raged over whether we will face deflation or inflation. We can now conclude we will have a toxic combination of both, known as stagflation.

Stagflation is the phenomenon of rising prices and falling demand and production. It was first experienced in the late seventies and although it eventually disappeared, there was never a good explanation for it.

Proponents of both sides of the aforementioned debate had strong arguments.

Deflationists said the banks were insolvent and would not be able to provide credit, leading to a diminishing money supply and declining prices.

Inflationists said Central Banking and Governmental policies of bail outs, QE1,2,x and stimulus would lead to more money in circulation, with rising prices as a result.

Both were right, but they missed a crucial point. There are two economies. One is the real economy, where you and I operate. We work and make stuff. Cars, food, all sorts of services.

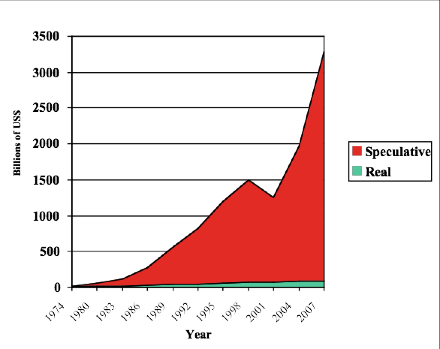

And there is also the financial economy. This is the shadowy world of finance, FOREX, stock exchanges, commodity exchanges. The graph below shows the vast scale of this financial economy, which is many times bigger than the real economy.

Graph by Margrit Kennedy and Bernard Lietaer, based on BIS figures

Graph by Margrit Kennedy and Bernard Lietaer, based on BIS figuresThe transaction volume for the financial economy is in red and the real economy is in green. At this point we are talking about 5 trillion worth of transactions per day in the financial economy, many times more than in the real economy. We can also see that while the real economy grows in linear fashion, the financial economy grows exponentially. The unexpected decline we see around 2000 is explained by the introduction of the euro, which diminished FOREX speculation. A small price to pay for that giant leap towards World Currency.

It also shows that the financial sector began only in the early seventies. This is explained by the rise of the computer. Most people don't realize that even in the early sixties, most wages were paid weekly.....in cash. It is the computer that made it possible for banks to connect everybody to their system. It also explains why stagflation had not been around before the late seventies.

The financial and real economies to some extent interact, primarily via commodity exchanges. But the financial economy is largely isolated. Most of the hot money never reaches the real economy.

Thankfully, otherwise the dollar wouldn't even be worth the 1% of its 1913 purchasing power it has now. This is so, because for instance, FOREX is just an eternal ping pong of transactions within the banking sector, leading to an eternal wealth transfer from the not-so-savvy to the "usual suspects."

The two parallel economies also explain why price rises have not kept up with the expansion of credit. A lot of the newly created money was siphoned off to the financial economy.

We have a deflation in the real economy but a massive inflation in the financial economy. Stagflation is coming because a portion of this hot money is now entering the commodity markets, leading to inflation in the primary sector (agriculture and mining). These rising prices will be passed on by producers in the secondary and tertiary sectors (industry and services.)

An example of this process were the skyrocketing oil prices in 2009. It has been established that Goldman Sachs was using TAARP funds to drive up prices.

Another example is the current rise in food prices. Or what do we think of JPM cornering the copper market?

The deflation in the real economy is caused by the credit crunch, and by the new Capital Reserve Requirements that were foisted upon the banking system by the Bank of International Settlements.

Meanwhile corporations are choked by lack of credit and going out of production, resulting in rising unemployment.

So what does the future look like? We will be facing rising prices while the economy will be depressed, i.e. declining production and high levels of unemployment. This will result in volatility in the commodity markets, something we are now seeing with commodity stocks correcting by as much as one third.

I would like to express my appreciation for Dick Eastman's courageous and groundbreaking thoughts on the parallel economies and its implications.

Anthony Migchels' Website

---

Financial Times on Stagflation

The Guardian on Stagflation

Inflated Prices

Well, for most Americans, the cost of living is indeed rising. Prices for basic human needs such as food, clothing, heat and transportation have increased dramatically over the last two years. The average price for regular gasoline in the US is $3.12 per gallon, the highest level since July 2008 and 62 cents/gal higher than the peak price during the 1974 oil embargo. General prices, as measured by CPI growth, are ticking up worldwide. Food prices are exploding here and around the world. Although drought conditions of 2010 contributed to the spike in grain prices, the major cause is government intervention.

Well, for most Americans, the cost of living is indeed rising. Prices for basic human needs such as food, clothing, heat and transportation have increased dramatically over the last two years. The average price for regular gasoline in the US is $3.12 per gallon, the highest level since July 2008 and 62 cents/gal higher than the peak price during the 1974 oil embargo. General prices, as measured by CPI growth, are ticking up worldwide. Food prices are exploding here and around the world. Although drought conditions of 2010 contributed to the spike in grain prices, the major cause is government intervention.

Government has attempted to control prices using monetary policy, government subsidies for selected industries and emergency executive order. The Fed tries to control inflation (and more recently, unemployment) by easing or tightening interest rates. The Fed has cut rates to near zero, after lowering rates continually since 2007. The easy money policy is designed to stimulate economic activity and "manage" inflation to acceptable (low) levels. Congress has enacted a series of farm bills since 1965 to subsidize US agribusiness. The current farm bill, the Food and Conservation and Energy Act of 2008, provided $288 Billon in direct subsidies, including increased allocations for biofuels (ethanol). Presidents Roosevelt, Truman, Nixon and Carter all implemented direct price or price-wage controls to disastrous affect (I remember waiting in line for my ration of 8 gallons of gas on odd calendar days in 1974).

History has shown that price controls, however implemented, simply do not work. Fixing prices below natural market levels has been tried since ancient Rome. In the French Revolution, the "Law of the Maximum" sent offenders to the guillotine. The Soviet Union's central planners controlled all prices and also created a vigorous black market. In the US, World War I commissions and later during WWII, FDR's Office of Price Administration set prices in broad markets. The result was severe shortages in many staples, including meat. Although controls were eventually lifted for most products after the war, control of meat prices continued. In 1946, Truman nearly sent federal troops to Chicago to free up meat supplies from packing-house "hoarders".

The fundamental cause of general inflation is excessively expansive monetary policy, that is, printing money at a rate higher than the growth in GDP. "Excess money" devalues the medium of exchange, and drives prices up for needed products and services. The rise in commodity prices over the last two years is a good example. Since the Fed added $1.4 Trillion to the money supply two years ago, commodity prices have skyrocketed 80% from 2009 levels. Commodity price increases flow to producer prices and eventually into consumer prices. The Consumer Price Index (CPI) is compiled and reported by the Bureau of Labor Statistics.

The CPI, as published, is deceptive. It does not reflect the true inflation rate observed by most individual consumers. This is because the published numbers are composed of certain components, assumed to be representative of the average consumer's "basket of goods". This can vary significantly from, for example, fuel costs differ greatly for the person who drives a super-duty truck for work every day compared to the urban office worker who relies exclusively on public transportation. People tend to have differing diets as well, as a result of tradition, religion or culture. So the common basket of goods is a myth.

We can point to real food price increases by a few common examples: at the wholesale level, whole chickens cost 69c/lb in Dec 2006, and 85c/lb Dec 2010, according to USDA data; Sugar cost 11.7c/lb in Dec 2006 and 31c/lb in Dec 2010. Where I live, a 3 1/4 lb whole chicken sells today for $8.

In Dec 2006, coffee cost $1.29/lb wholesale and climbed to $2.37/lb wholesale by Dec 2010. I paid $3.25/lb this week for coffee at my local grocery.

Since I need to buy food, heat my house and drive my car, how can I protect myself from inflation? For certain, I won't rely on the Federal government. I will rely on my own good judgment.

I will invest some of my discretionary income in gold and silver as a hedge against inflation, which I expect will accelerate in the near future and further devalue the paper dollars I earn. With hard assets in my portfolio, I spread my risk. Gold has never been worth zero. It has quadrupled in value over the last ten years. I will also stay invested in gold and silver stocks. Although these can be more volatile than the metals, the inflation premium is discounted the market price, a distinct advantage over fixed income securities, such US Treasury notes.

Mervyn King says pay squeeze necessary

From the BBC:

From the BBC:Mervyn King has said that the squeeze on UK take-home pay is necessary.

Speaking in Newcastle, the Bank of England governor said the current high inflation rate was unavoidable as the UK economy adjusts to higher commodity prices and becomes more competitive.

He said inflation was likely to rise further to 4-5% in the coming months, before falling back sharply from 2012.

And he implied that the Bank would thwart attempts by wage-setters to keep up with the above-target price rises.

"Further rises in world commodity and energy prices cannot be ruled out," he said in his speech.

"Attempts to resist their implications for real take-home pay by pushing up wages would require a response [from the Bank's monetary policy committee]."

Despite this warning, his speech - which came in the wake of a surprise 0.5% contraction in the UK economy in the last three months of 2010 - appeared to downplay the chances of the Bank raising interest rates any time soon......read on

Financial Crisis Was Avoidable, Inquiry Finds

From the NY Times:

From the NY Times:WASHINGTON — The 2008 financial crisis was an “avoidable” disaster caused by widespread failures in government regulation, corporate mismanagement and heedless risk-taking by Wall Street, according to the conclusions of a federal inquiry.

The commission that investigated the crisis casts a wide net of blame, faulting two administrations, the Federal Reserve and other regulators for permitting a calamitous concoction: shoddy mortgage lending, the excessive packaging and sale of loans to investors and risky bets on securities backed by the loans.

“The greatest tragedy would be to accept the refrain that no one could have seen this coming and thus nothing could have been done,” the panel wrote in the report’s conclusions, which were read by The New York Times. “If we accept this notion, it will happen again.”.......read on