Here at Casey Research, our view of the Great Depression of the 1930s is a little different from that of most people. In our eyes, Franklin Roosevelt wasn't a hero, he was a villain. Nearly everything he did served to extend and deepen the economic downturn. With the exception of supporting the 21st Amendment for the repeal of Prohibition, Roosevelt's involvement in the economy was an unmitigated disaster. But in popular memory, that failure is obscured by U.S. success in WW2, over which Roosevelt presided.

Today, unfortunately, Obama and his minions are taking Roosevelt as a model and are straining to repeat his mistakes. Because the distortions in today's economy are far greater than those in the 1920s and 1930s, and since the public now relies upon government far more than it did in those days, I don't see any way around a more serious depression - the Greater Depression. It's been going on since 2008, will get much worse, and has years left to run.

FDR himself was extraordinarily lucky. His performance looks successful because when he entered office, both the economy and the stock market were overdue for a cyclical recovery (nothing goes straight down forever). He was elected when the depression had already been going on for four years and the stock market had already fallen 90%. That fortunate timing was partly a gift from Hoover, whose large-scale interference in the economy had kept the depression going. (It's odd how people believe Hoover was the free-marketeer and Roosevelt was the interventionist. Roosevelt really just continued and extended Hoover's policies, but with more enthusiasm and far better PR.)

Roosevelt had more good luck (for him) with the arrival of WW2; the victories in Europe and the Pacific forever idealized every aspect of his administration. In many ways, the cult of FDR resembles that of Russia's Joseph Stalin, who is still worshipped there as a demigod.

Although Obama seems bright enough, there's little reason to believe he's a student of history and no reason to believe he's a student of economics. It's more likely that he's just a student of power politics, so he's inclined to follow the conventional wisdom, which is that a combination of Roosevelt's "bold action" in the New Deal plus World War 2 brought the country out of the Great Depression. What we hope to show here is that those notions are nonsense.

The Last Depression

How, in fact, did America recover from the Great Depression? The stock answer is: "World War 2." But a closer look at the data reveals a different answer.

Standard mythology claims that war production - beginning in 1939 - ended our economic troubles. But the American economy didn't truly recover until two years after the fighting stopped in 1945. In point of fact, the last depression ran from 1929 to 1947, about 18 years.

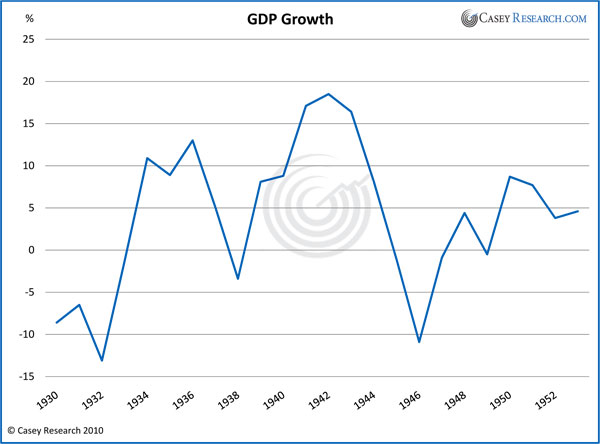

And it wasn't a single terrible decline. As the chart above shows, GDP growth was falling in 1930, recovered from 1932 to 1936, and then began a second collapse in 1937, a down-leg due mostly to Roosevelt's policies.

Then, in 1939, industrial production began a tremendous expansion. The unemployed were put to work either fighting or manufacturing armaments. But neither activity contributed to the general standard of living. And even if it had, the growth in production wasn't and couldn't have been self-sustaining, since it was in fact a growth in the squandering of resources.

The conventions for measuring GDP include government expenditures, so GDP is a poor measure of underlying economic health. The government might, for instance, hire 10 million people to dig ditches during the day, 10 million more to fill them in at night, and 5 million bureaucrats to monitor the work. That would pump up GDP and reduce unemployment, but it wouldn't increase society's wealth. It would decrease it.

In any event, as soon as the government's large wartime expenditures started dropping in 1945, GDP resumed the shrinking that had begun in 1930.

The GDP growth of the war years was a prosperity mirage that dissipated when government spending stopped, unlike the wealth-creating expansion from 1932 to 1936 that had been fueled by private investment. In 1936, GDP rose $10.5 billion while government spending rose just $2.2 billion. In 1942, GDP rose $35.2 billion while government spending rose $36.1 billion. The apparent growth during the war was all government spending.

Roosevelt's Second Act

What caused the recovery to collapse in 1936?

One element was Roosevelt's attack on the rich. In 1935, he launched a barrage of new taxes, including a corporate income tax of 15%, a dividend tax, higher estate and gift taxes, and additional taxes on those earning more than $50,000. The top rate on individual income taxes rose to 79% in 1936, a large jump from 63% just the previous year.

On top of this, Roosevelt's rhetoric and actions turned increasingly anti-business. Roosevelt began to strongly support organized labor - which was nice for those who had union cards, but no help for those who didn't have the connections or skin color to get one, and great harm for the economy as a whole. His support got results. In 1935, there were only 3.8 million union members in the U.S. By 1941, there were about 10 million, approximately a quarter of the workforce.

The 1936 elections gave the country de facto one-party rule - 76 Democrats in the Senate and 331 Democrats in the House of Representatives. Each new piece of legislation berated and punished business - such as the Wagner Act, the ever higher taxing Revenue Acts, and Undistributed Profits Tax. With the government growing larger while business lacked strong representation in the halls of power, it is no wonder that private investment stalled.

Government Versus Private Investment

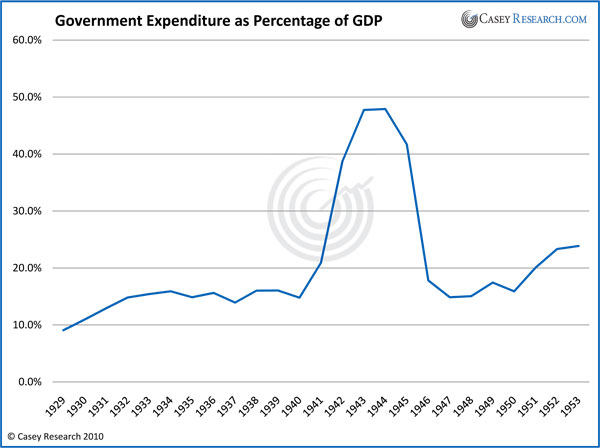

Government expenditure as a percentage of GDP drives the point home even more. Throughout World War 2, the private market remained in the dumps.

War spending added to the GDP numbers. And there was real progress in areas like aviation, electronics, and atomic energy - albeit at a gigantic cost. But none of this jump-started the private economy, which focuses on the products and services people really want.

You don't need a doctorate in economics to understand this chart. The only major peak during the war marks the end of hostilities - and FDR's death. (We'll get to that in a moment). Note that the 1932-1936 recovery was far more significant than the often-glorified war economy.

Why didn't FDR's immense spending jolt the private market back to life? Remember that a wartime economy comes with strings attached; it's not free money. Wartime regulations made operating any business almost impossible. Nearly everything required government permission. Taxes skyrocketed, leaving less capital for investment. Further, forget about competing for resources with the war industry; even if you had a good business idea, you wouldn't be allowed to execute it.

An economy can't prosper when markets are being overruled by command-and-control rationing. During the war, companies found it easier and more profitable to produce for government than to produce for consumers. Even companies such as Eastman Kodak, the film and camera company, began manufacturing rifle scopes and hand grenades for the military. GM stopped making cars for civilians and made military vehicles instead. Tires, gasoline, shoes, beef, sugar, coffee and much else were rationed. The standard of living in the U.S. during the war collapsed; conditions for consumers were much worse than in the '30s. Remember that the best definition of a depression is: A period of time when most people's standard of living falls significantly.

Without productive private investment, recovery is impossible. Near the end of the war, as government spending subsided, private investment did return to the U.S. But that never happened in the USSR, China, or Eastern Europe, which is why they never did recover. Lack of private investment is why Britain remained something of a dump right up to the election of Thatcher. Wartime spending didn't help the recovery, it slowed it.

During the war, a majority of businessmen - typically over 75% - believed the U.S. would retain the fascist-style economic system that it had grown into during the '30s and that it seemed to be cemented into by the war. With that thought so widespread, the lack of private investment is no surprise.

But with the closing of WWII, the fear of being locked into a command-and-control economy began to ease - an unintended consequence of FDR's wiliness. FDR knew that the business world would cooperate in wartime production only if business leaders were running the show. He slowly began replacing New Dealers in his administration with the businessmen who had been squashed by New Deal policies. The new recruits worked behind the scenes in Washington to undo what the early New Dealers had accomplished. Necessity had overcome ideology.

On top of that, the Democrats were losing their grip on Congress. By 1944, they had only 56 senators and 242 representatives. In 1946, the Republicans regained both houses of Congress.

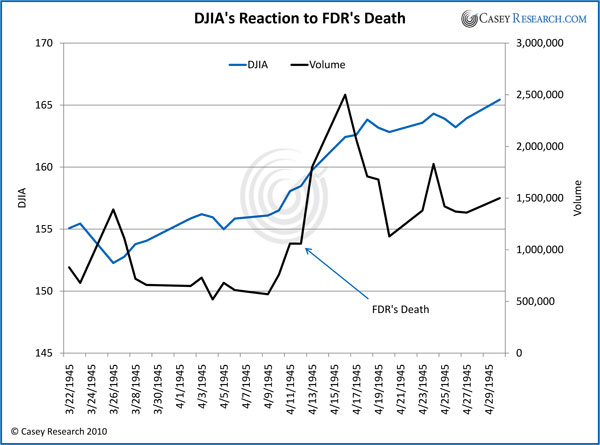

And FDR himself died, which left businessmen feeling a lot safer. The long dark night of anti-business tirades and crusades had ended. The Dow made a significant jump, and so did the daily volume on his death.

Sure, Truman was still around, but he didn't have Roosevelt's dangerous popularity. As a result, private investment flooded the post-war market, and a boom followed. Where did the capital to fuel the post-war boom come from? In a way, it was an accident of wartime policies.

During the war, the personal savings rate skyrocketed. There were plenty of reasons for that. For one, quality durable goods exempt from wartime rationing were difficult to find even if one wanted to buy them. Second, a big war creates uncertainty. If you're not sure whether a husband or father will return alive, saving makes sense. The importance of savings in the 1940s is a reason for pessimism about our prospects today: unlike during WW2, today's savings rate is still negligible. And the artificially low interest rates the government has engineered continue to discourage saving and to encourage consumption, debt, and speculation.

When the war ended, the accumulated savings supported both investing and consumer spending. It's an experience that refutes the Keynesian notion that consumer spending stimulates the economy and saving suppresses it.

You can't solve today's problem of overconsumption and debt with more overconsumption and debt. The conditions that pulled America out of the Great Depression underscore that point. Once savings rates increased and made capital available for the economy, private investment soared, and shortly afterward, so did the rest of the economy.

Although history doesn't repeat, this time it definitely rhymes. The Obama administration is trying to replay all of Roosevelt's moves, and it's making all of FDR's mistakes in spades and more. The Obama bailouts of public companies are a new twist - even FDR didn't go that far. The U.S. is already in a war economy. Will Obama ramp up the wars, thinking that what's been done so far isn't enough?

The bottom line is that, based on everything we know about the Great Depression, the Greater Depression, which is still in its early stages, is going to be nasty indeed.

From the UK Telegraph:

From the UK Telegraph: