Tuesday, January 31, 2012

Why Are the Chinese Buying Record Quantities of Gold?

From Forbes.com

This month, the Hong Kong Census and Statistics Department reported that China imported 102,779 kilograms of gold from Hong Kong in November, an increase from October’s 86,299 kilograms. Beijing does not release gold trade figures, so for this and other reasons the Hong Kong numbers are considered the best indication of China’s gold imports.

Analysts believe China bought as much as 490 tons of gold in 2011, double the estimated 245 tons in 2010. “The thing that’s caught people’s minds is the massive increase in Chinese buying,” remarked Ross Norman of Sharps Pixley, a London gold brokerage, this month.

So who in China is buying all this gold?

The People’s Bank of China, the central bank, has been hinting that it is purchasing. “No asset is safe now,” said the PBOC’s Zhang Jianhua at the end of last month. “The only choice to hedge risks is to hold hard currency—gold.” He also said it was smart strategy to buy on market dips. Analysts naturally jumped on his comment as proof that China, the world’s fifth-largest holder of the metal, is in the market for more.

Read more

This month, the Hong Kong Census and Statistics Department reported that China imported 102,779 kilograms of gold from Hong Kong in November, an increase from October’s 86,299 kilograms. Beijing does not release gold trade figures, so for this and other reasons the Hong Kong numbers are considered the best indication of China’s gold imports.

Analysts believe China bought as much as 490 tons of gold in 2011, double the estimated 245 tons in 2010. “The thing that’s caught people’s minds is the massive increase in Chinese buying,” remarked Ross Norman of Sharps Pixley, a London gold brokerage, this month.

So who in China is buying all this gold?

The People’s Bank of China, the central bank, has been hinting that it is purchasing. “No asset is safe now,” said the PBOC’s Zhang Jianhua at the end of last month. “The only choice to hedge risks is to hold hard currency—gold.” He also said it was smart strategy to buy on market dips. Analysts naturally jumped on his comment as proof that China, the world’s fifth-largest holder of the metal, is in the market for more.

Read more

Gerald Celente on ZIRP and Gold

A powerful, wide ranging interview on the Fed's interest rate policy and the resultant effect on Gold and Silver with Eric King of King World News.......listen here

Monday, January 30, 2012

Reflecting on Sunnier times

By James Delingpole

By James Delingpole There's a great piece by David Rose in the Mail On Sunday nicely summing up what a lot of us here knew already: that the thing we really need to fear right now is not global warming but global cooling. And that, on current evidence, it's global cooling we're going to get.

The supposed ‘consensus’ on man-made global warming is facing an inconvenient challenge after the release of new temperature data showing the planet has not warmed for the past 15 years.

The figures suggest that we could even be heading for a mini ice age to rival the 70-year temperature drop that saw frost fairs held on the Thames in the 17th Century.

Based on readings from more than 30,000 measuring stations, the data was issued last week without fanfare by the Met Office and the University of East Anglia Climatic Research Unit. It confirms that the rising trend in world temperatures ended in 1997. Rose's piece comes hot on the heels of an op-ed in the Wall Street Journal signed by 16 distinguished scientists (proper ones: not "climate" "scientists") noting the continuing absence of ManBearPig.

Read more

Pretend Money

Pity they haven't arrested Ben Bernanke for also producing high quality notes pretending to be money.

"Paper is poverty,… it is only the ghost of money, and not money itself" ~ Thomas Jefferson 1788

Jan 26, 2012 by Euronews

"Paper is poverty,… it is only the ghost of money, and not money itself" ~ Thomas Jefferson 1788

Jan 26, 2012 by Euronews

BDI continues to plunge

As mentioned in this earlier post the BDI (Baltic Dry Index) is currently plunging, and has in fact fallen another 20% in last week. I have seen bricks with greater aerodynamics than this index. This is not looking good for any global recovery in the near term.

Sunday, January 29, 2012

Doug Casey talks to James Turk

I have posted this interview before, but if you missed it Doug Casey's thoughts are a very deep and wide ranging, and a excellent primer for what awaits us over the next few years.

GoldMoneyNews | Nov 11, 2011

GoldMoneyNews | Nov 11, 2011

Juan Ramón Rallo and Alasdair Macleod talk about the Spanish economy, gold and silver

GoldMoneyNews on Jan 23, 2012

In this video Juan Ramón Rallo, economist and university professor in Madrid, and Alasdair Macleod of the GoldMoney Foundation talk about the Spanish economy, gold and silver.

News Analysis reviews the American Awakening

PressTVGlobalNews on Jan 28, 2012

This edition of News Analysis reviews the American Awakening and the US protests.

David Frost interviews Mohamed El Erian

Top interview with Mohamed El Erian (PIMCO CEO), unfortunately it is followed by a poor interview with a US political hack, but that is what the pause button is for.

AlJazeeraEnglish on Jan 28, 2012

John Embry - Gold, China and Quantitative easing to infinity

Sprott Asset Management's John Embry believes that the prospect of global "Weimar situation" is very real and bullish for gold. Listen to him discuss this with Geoff Candy here

The Silver Singularity Is Near

By Mike Scully from SeekingAlpha

Price, as they say, is determined on the margins. This is especially true for inelastic goods. If 100 Tickle Me Elmo dolls exist in Walmart on Christmas eve, and 100 people absolutely need to have them, you don't have a problem. The price will be some reasonable markup on the cost of production. However, if one more person walks in fearing the wrath of his child if there's no Elmo under the tree, Walmart ( WMT ) can quickly turn into a war zone. In Walmart, this supply shortage might be settled by shoving and hair pulling. In a civilized market, this supply, demand inequity is settled with price. In the case of Elmo in 1996, some dolls were reportedly sold in aftermarkets for $1500.

This is an important concept to keep in mind when evaluating the silver market. Silver is interesting because it is actually two different markets. On one hand, silver is a physical commodity that is used in industry or warehoused as physical savings. This market is rather inelastic on the supply and demand side as I will discuss in a bit. On the other hand is the silver derivatives market, paper contracts for silver, that set the spot price on the margins. The paper market is elastic and depends more on investor psychology than underlying fundamentals.

Read more: http://community.nasdaq.com/News/2012-01/the-silver-singularity-is-near.aspx?storyid=117209#ixzz1knqtOcEn

Price, as they say, is determined on the margins. This is especially true for inelastic goods. If 100 Tickle Me Elmo dolls exist in Walmart on Christmas eve, and 100 people absolutely need to have them, you don't have a problem. The price will be some reasonable markup on the cost of production. However, if one more person walks in fearing the wrath of his child if there's no Elmo under the tree, Walmart ( WMT ) can quickly turn into a war zone. In Walmart, this supply shortage might be settled by shoving and hair pulling. In a civilized market, this supply, demand inequity is settled with price. In the case of Elmo in 1996, some dolls were reportedly sold in aftermarkets for $1500.

This is an important concept to keep in mind when evaluating the silver market. Silver is interesting because it is actually two different markets. On one hand, silver is a physical commodity that is used in industry or warehoused as physical savings. This market is rather inelastic on the supply and demand side as I will discuss in a bit. On the other hand is the silver derivatives market, paper contracts for silver, that set the spot price on the margins. The paper market is elastic and depends more on investor psychology than underlying fundamentals.

Read more: http://community.nasdaq.com/News/2012-01/the-silver-singularity-is-near.aspx?storyid=117209#ixzz1knqtOcEn

Keiser Report: State Of The Banana

RussiaToday on Jan 28, 2012

In this episode, Max Keiser and co-host, Stacy Herbert, discuss the State of the Banana Republic, the blowout at Apple with its profits 'trapped' overseas and the gloomy State of the Stiff Upper Lip as UK family debts soar by nearly 50%. And, finally, Max and Stacy examine a proposal that bankers, like Goldman Sachs' Lloyd Blankfein and JP Morgan's Jamie Dimon, should compete like strippers on the open job market.

In this episode, Max Keiser and co-host, Stacy Herbert, discuss the State of the Banana Republic, the blowout at Apple with its profits 'trapped' overseas and the gloomy State of the Stiff Upper Lip as UK family debts soar by nearly 50%. And, finally, Max and Stacy examine a proposal that bankers, like Goldman Sachs' Lloyd Blankfein and JP Morgan's Jamie Dimon, should compete like strippers on the open job market.

Saturday, January 28, 2012

Jim Rickards on Oil for Gold

Jim Rickards discusses the Fed's press conference in regards to keeping ZIRP until late 2014 and the revelation that India will buy oil from Iran for Gold.......listen here

These guys have cojones made of plata

One of the greatest interviews I have listened to on silver. These guys are a Silver Bug's Silver Bug.

The Birther's Victory In Atlanta Court

ATLAHWorldwide on Jan 26, 2012

http://www.atlah.org

Dr. James David Manning interviews Carl Swensson on the victory in Atlanta Court.

Dr. James David Manning interviews Carl Swensson on the victory in Atlanta Court.

David Morgan interviewed by Ellis Martin

opportunityshow on Jan 27, 2012

Ellis Martin and David Morgan visit at

the Vancouver Resource Investment Conference where there was record

attendance, portending untold investor interest in Canadian Junior

Mining Companies and precious metals in general, the likes of which have

not been seen previously. Mr. Morgan forecasts another leg up in silver

and gold.

Gold and Silver end the week higher, expected to move higher

Both Gold and Silver ended the week significantly higher on the back of continued FOMC repression. The first week of the Year of Dragon is definatly proving to be interesting. Whilst on that topic, most Chinese buyers have been on a week's holiday to celebrate the new year, they will return come Monday.

On average most buying pressure comes during trading hours in the East and most selling during the Western trading hours as Gold and Silver continue their slow migration eastward. So it is expected that Gold and Silver will continue to trade higher in the coming week as this dynamic restarts.

On average most buying pressure comes during trading hours in the East and most selling during the Western trading hours as Gold and Silver continue their slow migration eastward. So it is expected that Gold and Silver will continue to trade higher in the coming week as this dynamic restarts.

Even Aliens prefer Gold to Fiat Currencies

I watched the movie "Cowboys and Aliens" last night. A brilliant movie, but the high point for me was the fact that these alien monsters had came across the galaxy not to steal our women, our US treasury bonds or our multitude of fiat currencies, no they came to steal our Gold! To quote Olivia Wilde's character "Gold is rare on their planet too". The alien bugs even bring their own ore crushing mill, refinery equipment and 457 visas.

Weekend Chillout - When is it enough?

It seems the world is yet again focused on the trinity of current existence, Oil, US$ and Gold. This week has seen increasing tensions with the West v. Iran, UK v. Argentina both due to Oil, and Iran rejecting the US Petrodollar in exchange for Gold. It makes me wonder if the world is enough for the illuminated ones.

Paul Craig Roberts on Iran v. US

|

| CVN-65 USS Enterprise without Capt. Kirk |

If it requires 11 aircraft carriers to deal with Iran, how many will Panetta need to project power against Russia and China? But to get on with the main point, Iran has been trying “to deal with us through diplomacy.” The response from Washington has been belligerent threats of military attack, unfounded and irresponsible accusations that Iran is making a nuclear weapon, sanctions and an oil embargo. Washington’s accusations echo Israel’s and are contradicted by Washington’s own intelligence agencies and the International Atomic Energy Agency. Why doesn’t Washington respond to Iran in a civilized manner with diplomacy? Really, which of the two countries is the greatest threat to peace?

Washington sends the FBI to raid the homes of peace activists and puts a grand jury to work to create a case against them for aiding a nebulous enemy by protesting Washington’s wars. The Department of Homeland Security unleashes goon cop thugs to brutalize peaceful Occupy Wall Street demonstrators. Washington fabricates cases against Bradley Manning, Julian Assange, and Tarek Mehanna that negate the First Amendment by equating free speech with terrorism and spying. Chicago mayor and former Obama White House chief-of-staff, Rahm Israel Emanuel, pushes an ordinance that outlaws public protests in the City of Chicago. The list goes on. And in the midst of it all Secretary of State Hillary Clinton and other Washington hypocrites accuse Russia and China of stifling dissent.

Washington’s grotesque hypocrisy goes unremarked by the American “media” and in the debates for the Republican presidential nomination. The corrupt Obama “Justice” Department turns a blind eye while goon cop thugs commit gratuitous violence against the citizens who pay the goon cop thugs’ undeserved salaries.

But it is in the War Crimes Arena where Washington shows the greatest hypocrisy. The self-righteous bigots in Washington are forever rounding up heads of weak states whose countries were afflicted by civil wars and sending them off to be tried as war criminals. All the while Washington indiscriminately kills large numbers of civilians in six or more countries, dismissing its own war crimes as “collateral damage.” Washington violates its own law and international law by torturing people.

On January 13, 2012, Carol Rosenberg of McClatchy Newspapers reported that Spanish judge Pablo Rafael Ruz Gutierrez re-launched an investigation into Washington’s torture of prisoners in Guantanamo Prison. The previous day British authorities opened an investigation into CIA renditions of kidnapped persons to Libya for torture.

Rosenberg reports that although the Obama regime has refused to investigate the obvious crimes of the Bush regime, and one might add its own obvious crimes, “other countries are still interested in determining whether Bush-era anti-terror practices violated international law.”

There is no question that Bush/Cheney/Obama have trashed the US Constitution, US statutory law, and international law. But Washington, having overthrown justice, has established that might is right. No foreign government is going to send its forces into the US to drag the war criminals out and place them on trial.

The War Criminal Court at the Hague is reserved for Washington’s show trials. No foreign government is going to pay Washington several hundred millions of dollars to turn Bush, Cheney, Obama and their minions over to them in the way the US bought Milosevic from Serbia in order to create the necessary spectacle at the War Crimes Tribunal to justify Washington’s naked aggression against Serbia.

No government can be perfect, because all governments are composed of humans, especially those humans most attracted by power and profit. Nevertheless, in my lifetime I have witnessed an extraordinary deterioration in the integrity of government in the United States. We have reached the point where nothing that our government says is believable. Not even the unemployment rate, the inflation rate, the GDP growth rate, much less Washington’s reasons for its wars, its police state, and its foreign and domestic policies.

Washington has kept America at war for ten years while millions of Americans lost their jobs and their homes. War and a faltering economy have exploded the national debt, and a looming bankruptcy is being blamed on Social Security and Medicare.

The pursuit of war continues. On January 23 Washington’s servile puppets--the EU member states--did Washington’s bidding and imposed an oil embargo on Iran, despite the pleas of Greece, a member of the EU. Greece’s final ruin will come from the higher oil prices from the embargo, as the Greek government realizes.

The embargo is a reckless act. If the US navy tries to intercept oil tankers carrying Iranian oil, large scale war could break out. This, many believe, is Washington’s aim.

It is easy for an embargo to become a blockade, which is an act of war. Remember how easily the UN Security Council’s “no-fly zone” over Libya was turned by the US and its NATO puppets into a military attack on Libya’s armed forces and population centers supportive of Gaddafi.

As the western “democracies” become increasingly lawless, the mask of law that imperialism wears is stripped away and with it the sheen of morality that has been used to cloak hegemonic ambitions. With Iran surrounded and with two of Washington’s fleets in the Persian Gulf, another war of aggression seems inevitable.

Experts say that an attack on Iran by the US and NATO will disrupt the flow of oil that the world needs. The crazed drive for hegemony is so compelling that Washington and its EU puppets show no hesitation in putting their own struggling economies at risk of sharply rising energy costs.

War abroad and austerity at home is the policy that is being imposed on the western “democracies.”

Friday, January 27, 2012

Don't mention the Oil

PressTVGlobalNews on Jan 26, 2012

A prominent political analyst says UK's David Cameron is mocking Argentina after criticizing the country of "colonialism" while Britain still has colonies around the world.

An interview with Chris Bambery, political analyst.

A prominent political analyst says UK's David Cameron is mocking Argentina after criticizing the country of "colonialism" while Britain still has colonies around the world.

An interview with Chris Bambery, political analyst.

The Petro-Dollar is at risk

PressTVGlobalNews on Jan 26, 2012

A prominent online columnist says Western-backed sanctions on Iran have lost their credibility, and will not dissuade many countries from trading with the Islamic Republic.

An interview with Allen Roland, online columnist.

A prominent online columnist says Western-backed sanctions on Iran have lost their credibility, and will not dissuade many countries from trading with the Islamic Republic.

An interview with Allen Roland, online columnist.

Brazil's millionaires increasing in numbers

AlJazeeraEnglish on Jan 25, 2012

An interesting contrast to the "developed" world. In the West, society, banks and government are actively destroying the middle class through falling home, business and paper asset values. Whereas in the BRIC nations, such as Brazil, they are dragging tens of millions out of poverty, and along the way creating 19 new millionaires per day.

Let that sink in and then reflect that during the last bull market in Gold and Silver the BRIC countries' people were overwhelming poor and or under communist repression, and none of their population participated in a market in which gold increased in price 25 times and silver 35 times. Now we have 100's of millions of people in BRIC nations with enough savings to buy some gold or considerably more silver, given this how can this bull market not end in multiples of the returns seen in the 70's?

An interesting contrast to the "developed" world. In the West, society, banks and government are actively destroying the middle class through falling home, business and paper asset values. Whereas in the BRIC nations, such as Brazil, they are dragging tens of millions out of poverty, and along the way creating 19 new millionaires per day.

Let that sink in and then reflect that during the last bull market in Gold and Silver the BRIC countries' people were overwhelming poor and or under communist repression, and none of their population participated in a market in which gold increased in price 25 times and silver 35 times. Now we have 100's of millions of people in BRIC nations with enough savings to buy some gold or considerably more silver, given this how can this bull market not end in multiples of the returns seen in the 70's?

Inside Story - Egypt: A year on and still unresolved?

AlJazeeraEnglish on Jan 26, 2012

It is exactly a year since the Egyptian revolution began, and only the banners have changed. Protesters have converged again in Tahrir Square calling for the next phase. What next for Egypt? Guests are: Wael Eskandar, Nader Omran and Sharif Kouddous.

It is exactly a year since the Egyptian revolution began, and only the banners have changed. Protesters have converged again in Tahrir Square calling for the next phase. What next for Egypt? Guests are: Wael Eskandar, Nader Omran and Sharif Kouddous.

Iran to place Oil sanactions on EU?

From RT.com

Iran may turn the sanctions tables by immediately stopping oil supply to Europe. The move is aimed as a response to the EU slapping an embargo on new oil contracts with Tehran. China has lashed out at the sanctions, calling them “blind pressure”.

The European sanctions, which follow a similar move by the US, provide for a grace period lasting until July 1, during which standing contracts with the Islamic Republic may be honored. However Iranian MPs are drafting a new law, which would stop short all supply to Europeans as soon as possible, according to Nasser Soudani, a member of the parliament’s energy committee.

“A number of representatives of the Majlis [Iranian parliament – RT] and I are seeking to approve a plan according to which all European countries that made Iran the target of their sanctions will not be able to buy even one drop of oil from Iran, and oil taps will be turned off to them so that they will not play with fire again,” Soudani told the Fars News Agency on Wednesday.

The legislation may be voted on in the parliament as early as this Sunday. If imposed, such a ban would result in a fuel shortage in Europe, as the countries, which joined the sanctions while receiving a considerable amount of crude from Iran, would not have enough time to secure a substitute.

Countries like Italy and Greece refine oil from Iran at plants tailored to a particular blend of crude, and readjusting them to another sort of oil would be costly both in terms of time and money. Soudani says the sanctions may eventually force buyers to acquire Iranian oil through intermediaries, and the cost of the fuel would be inflated by both rising market prices, and middlemen’s fees.

“European firms have no alternative but to enter into contracts with us, since abandoning Iran’s oil would mean the extinguishing of the candles of their economic lives,” the Iranian MP predicted......read more

Iran may turn the sanctions tables by immediately stopping oil supply to Europe. The move is aimed as a response to the EU slapping an embargo on new oil contracts with Tehran. China has lashed out at the sanctions, calling them “blind pressure”.

The European sanctions, which follow a similar move by the US, provide for a grace period lasting until July 1, during which standing contracts with the Islamic Republic may be honored. However Iranian MPs are drafting a new law, which would stop short all supply to Europeans as soon as possible, according to Nasser Soudani, a member of the parliament’s energy committee.

“A number of representatives of the Majlis [Iranian parliament – RT] and I are seeking to approve a plan according to which all European countries that made Iran the target of their sanctions will not be able to buy even one drop of oil from Iran, and oil taps will be turned off to them so that they will not play with fire again,” Soudani told the Fars News Agency on Wednesday.

The legislation may be voted on in the parliament as early as this Sunday. If imposed, such a ban would result in a fuel shortage in Europe, as the countries, which joined the sanctions while receiving a considerable amount of crude from Iran, would not have enough time to secure a substitute.

Countries like Italy and Greece refine oil from Iran at plants tailored to a particular blend of crude, and readjusting them to another sort of oil would be costly both in terms of time and money. Soudani says the sanctions may eventually force buyers to acquire Iranian oil through intermediaries, and the cost of the fuel would be inflated by both rising market prices, and middlemen’s fees.

“European firms have no alternative but to enter into contracts with us, since abandoning Iran’s oil would mean the extinguishing of the candles of their economic lives,” the Iranian MP predicted......read more

Keiser Report: Kill Hollywood!

RussiaToday on Jan 26, 2012

In this episode, Max Keiser and co-host, Stacy Herbert, discuss killing Hollywood, poor Chris Dodd and how Mubarak's fall brought about the assault on the internet. In the second half of the show, Max interviews Mike Ruppert about SOPA, the NDAA and Iranian oil.

In this episode, Max Keiser and co-host, Stacy Herbert, discuss killing Hollywood, poor Chris Dodd and how Mubarak's fall brought about the assault on the internet. In the second half of the show, Max interviews Mike Ruppert about SOPA, the NDAA and Iranian oil.

Thursday, January 26, 2012

The Petrodollar, Iran, and Gold

By Marin Katusa

By Marin KatusaRumors are swirling that India and Iran are at the negotiating table right now, hammering out a deal to trade oil for gold. Why does that matter, you ask? Only because it strikes at the heart of both the value of the US dollar and today's high-tension standoff with Iran.

Tehran Pushes to Ditch the US Dollar

The official line from the United States and the European Union is that Tehran must be punished for continuing its efforts to develop a nuclear weapon. The punishment: sanctions on Iran's oil exports, which are meant to isolate Iran and depress the value of its currency to such a point that the country crumbles.

But that line doesn't make sense, and the sanctions will not achieve their goals. Iran is far from isolated and its friends - like India - will stand by the oil-producing nation until the US either backs down or acknowledges the real matter at hand. That matter is the American dollar and its role as the global reserve currency.....read more

Priceless - Julian Assange to host show on RT

Personally I thought Julian should have been made Australian of the Year, but that no doubt would have p'ed off Barry, and we can't have that.

RussiaToday on Jan 25, 2012

RussiaToday on Jan 25, 2012

Easy Ben is a Gold and Silver Bugs best friend

Both Gold and Silver spiked higher in the New York trade on the pronouncement from the Fed that they expect to keep rates near zero until at least late 2014 (they also said tractor production was up and the Motherland was in great shape).

The FOMC edict was also accompanied for the first time by the individual stances of the FOMC commissars, as to raising rates; five said 2014, four said 2015, two said 2016, whilst three went for 2012 and another three went for 2013.

In response to the extending of the negative interest rate environment in the US Gold and Silver had this to say:

Wednesday, January 25, 2012

Oil-for-gold: Iran to dodge US ban with metal shield?

Very interesting development, as Gaddafi had proposed to sell Libyan Oil for Gold and we know how that turned out. For a RT video on Libyan Oil for Gold go here

RussiaToday on Jan 24, 2012

RussiaToday on Jan 24, 2012

Keiser Report: Dangerous Species of Bankers

RussiaToday on Jan 24, 2012

In this episode, Max Keiser and co-host, Stacy Herbert, discuss Google searching Davos; the Federal Open Market Committee getting high on its own money supply; bankers leaving the planet to live in parallel universes and the evidence for the manipulation of precious metals.

In this episode, Max Keiser and co-host, Stacy Herbert, discuss Google searching Davos; the Federal Open Market Committee getting high on its own money supply; bankers leaving the planet to live in parallel universes and the evidence for the manipulation of precious metals.

India to pay in Gold for Iranian Oil, China to follow

Seems history is repeating here. During the sanctions imposed on South Africa during the Apartheid era South Africa was able to bypass the oil embargo by offering to purchase Oil for Gold. Now we see Iran doing the reverse by selling Oil for Gold. Yet again Gold provides freedom from repression, just as it has done for the last 5,000 years.

Seems history is repeating here. During the sanctions imposed on South Africa during the Apartheid era South Africa was able to bypass the oil embargo by offering to purchase Oil for Gold. Now we see Iran doing the reverse by selling Oil for Gold. Yet again Gold provides freedom from repression, just as it has done for the last 5,000 years. From Debka.com

India is the first buyer of Iranian oil to agree to pay for its purchases in gold instead of the US dollar, debkafile's intelligence and Iranian sources report exclusively. Those sources expect China to follow suit. India and China take about one million barrels per day, or 40 percent of Iran's total exports of 2.5 million bpd. Both are superpowers in terms of gold assets.

By trading in gold, New Delhi and Beijing enable Tehran to bypass the upcoming freeze on its central bank's assets and the oil embargo which the European Union's foreign ministers agreed to impose Monday, Jan. 23. The EU currently buys around 20 percent of Iran's oil exports.

The vast sums involved in these transactions are expected, furthermore, to boost the price of gold and depress the value of the dollar on world markets.

Iran's second largest customer after China, India purchases around $12 billion a year's worth of Iranian crude, or about 12 percent of its consumption. Delhi is to execute its transactions, according to our sources, through two state-owned banks: the Calcutta-based UCO Bank, whose board of directors is made up of Indian government and Reserve Bank of India representatives; and Halk Bankasi (Peoples Bank), Turkey's seventh largest bank which is owned by the government.

An Indian delegation visited Tehran last week to discuss payment options in view of the new sanctions. The two sides were reported to have agreed that payment for the oil purchased would be partly in yen and partly in rupees. The switch to gold was kept dark.......read more

Tuesday, January 24, 2012

David Morgan at the Vancouver Investment Conference

TheSilverWatch on Jan 22, 2012

David Morgan speaks at the Vancouver Investment Conference, January 22, 2012

David Morgan speaks at the Vancouver Investment Conference, January 22, 2012

Australia to follow EU lead in banning Iranian oil

Anyone know what % of Australia's oil imports come from Iran?

Jan 24 (Reuters) - Australia will follow the EU lead in banning oil imports from Iran, the country's foreign minister Kevin Rudd said on Tuesday.

"On the question of Iran, let me be absolutely clear (regarding) the actions taken in Brussels yesterday on sanctions by the European Union -- we in Australia will undertake precisely the same parallel action for Australia," he told reporters during a visit to London......read more

|

| Countries Exporting Oil to Australia. Source: Matt Mushalik, based on data from http://tonto.eia.doe.gov/country/index.cfm |

|

| Kevin Rudd - Australia's Foreign Ministe |

"On the question of Iran, let me be absolutely clear (regarding) the actions taken in Brussels yesterday on sanctions by the European Union -- we in Australia will undertake precisely the same parallel action for Australia," he told reporters during a visit to London......read more

The Ron Paul Fix is in

One of the most powerful videos Sean has ever produced.

SGTbull07 on Jan 24, 2012 The Ron Paul FIX is in: a SGT micro-doc

http://sgtreport.com/

SGTbull07 on Jan 24, 2012 The Ron Paul FIX is in: a SGT micro-doc

http://sgtreport.com/

Pepe Escobar - EU needs Iran's oil, shoots itself into feet

RussiaToday on Jan 23, 2012

Reports from Iran suggest a fierce reaction to the EU's move to impose an embargo on Iran's crude exports. To discuss the implications of fresh sanctions against Iran, RT talks to Pepe Escobar - columnist and 'Asia Times' correspondent, from Bangkok.

Reports from Iran suggest a fierce reaction to the EU's move to impose an embargo on Iran's crude exports. To discuss the implications of fresh sanctions against Iran, RT talks to Pepe Escobar - columnist and 'Asia Times' correspondent, from Bangkok.

US deploys 12,000 troops in Libya

|

| Brega port - image from Google Maps |

Repeat after me - "we bombed Libya to protect the Libyan people".....if you say it often enough it will make you feel better when you go to gas pump.

From PressTV.ir

The United States has sent some 12,000 soldiers to Libya, in the first phase of deployments to the oil-rich North African nation.

According to Asharq Alawsat, the troops landed in the eastern oil port city of Brega.

Although the deployment is said to be aimed at generating stability and security in the region, the troops are expected to take control of the country's key oil fields and strategic ports.

Brega, the site of an important oil refinery, serves as a major export hub for Libyan oil. The town is also one of the five oil terminals in the eastern half of the country.

Following the popular uprising of the Libyan people, NATO launched a major air campaign against the forces of the former regime on March 19, 2011 under a UN mandate to “protect the Libyan population.”.....read more

Sen. Rand Paul on The Situation Room with Wolf Blitzer

This is a followup to this post

SenatorRandPaul on Jan 23, 2012

SenatorRandPaul on Jan 23, 2012

Sen. Rand Paul speaking with CNN's Wolf Blizter regarding his detainment by the TSA

Currency Wars - Iran Banned From Trading Gold and Silver

|

| CVN70 USS Carl Vinson |

Gold jumped to its highest in more than a month as result of the uncertainty over of the Greek debt outcome and the growing geopolitical tensions with Iran and the US and NATO countries.

The Iranian geopolitical tension is supporting gold as Britain, America and France have delivered a clear message to Iran, sending six warships led by a 100,000 ton aircraft carrier through the highly sensitive Strait of Hormuz.

Reuters report that the EU has agreed to freeze the assets of the Iranian central bank and ban all trade in gold and other precious metals with the Iranian Central Bank and other public bodies in Iran.

According to IMF data, at the last official count (in 1996), Iran had reserves of just over 168 tonnes of gold. The FT reported in March 2011 that Iran has bought large amounts of bullion on the international market to diversify away from the dollar, citing a senior Bank of England official.

Currency wars continue and are deepening.

A study in mass psychology

An amazing video of the group mind as was being discussed by James Dines in a earlier post. This is a perfect analogy to the silver bull market. A few nutters ignoring what others thought and started buying silver at US$4/oz then a few others join them at $8, then a few more at $15, and so on, then half of the rest of the crowd joins in when we get to $100, then everyone parties at $500 - $1,000/oz. Dorothy can you dance in those silver slippers?

Monday, January 23, 2012

Inflation - The only Tool Left

By Jim Willie CB, 20 January 2012

Any perusal around the world these days features Southern Europe crippled, preparing for the inevitable Greek Govt Bond default. It features a crippled US housing market, a mockery of statistical accounting in the US Gross Domestic Product, the plight of the COMEX with established veterans clearing out desks (not trading), the extreme physical demand reported by the London Trader, and the indictment of the SLV iTrust Silver Fund tool used by the cartel. The survey does not look favorable toward stability. The banking, economic, and political leaders have not pursued reform and remedy in any remote sense. Their only tool left is hyper inflation. The central banks of the Western nations have coordinated Global Quantitative Easing, as the USFed concealed its own QE3. Operation Twist was an enormous ruse, to cover the grand disposal sale (dump) by USGovt creditors and maintain a semblance of stability in the USTreasury market. The global financial crisis continues for a simple reason. No financial reform or remedy has been attempted, only bank-owned bond redemption and colossal aid to the financial sector that controls government ministries and law enforcement. Therefore, the crisis hurtles toward a series of climax events. The Chinese are accumulating physical Gold still in a big way. US finance minister, the diminutive Geithner admitted to the Chinese officials that the USGovt has no more tools left with which to stimulate or lift the USEconomy and its fumbling financial sector. An honest admission, except that hyper monetary inflation remains the all-in-one tool.

The Greek default could trigger some grand unintended consequences. Despite all the planning in the controlled event, likening it to the demolition of a 50-story hotel in an urban center, the better image might be to attempt to hold within a corral 500 cats released from a large truck. In no way can the technocrats, central banks, and bank officials contain the animal spirits coming. The only solution in the end will be the most massive hyper inflation project in history. They must recapitalize the broken banks of Europe, where fallout will surely extend in non-trivial manner to London and New York. Two major pressures will work to lift the Gold & Silver prices. The Commitment of Traders report on commercials points to a significant sequence where they covered their Gold shorts and Silver shorts since the summer months. The road is prepared for a big rise in price after some closing notes are played on the Dollar Death Dance. Details are seen in the January Hat Trick Letter. Also, the acute financial crisis in Europe and the West in general demands some important decisions to manage the Greek default. Look for talk of a monetary solution but action perhaps in a vast recapitalization program for the big banks. A footnote, the Citigroup earnings included a $1.5 billion release from their Loan Loss Reserves. The funds will be needed to cover bond impairment and mortgage related lawsuits. They also had a nice bump in the Credit Value Adjustment, a blatant accounting fraud that exploits gradual impairment to their own corporate bond value. Accounting for banks is a farce.

SOUTHERN EUROPE PERMANENTLY CRIPPLED

Although the entire southern rim is deeply affected, a look at Italy is telling as a microcosm of continental illness. Italy has imposed capital controls on the banks. Movement of funds is being closely monitored. Money cannot be withdrawn in volume at the bank windows. Borders have cameras and registries at the customs checkpoints. Italy has gone fascist with blazing speed, the most blatant indication is the installation of Monti as prime minister. Its banks are ready to capsize, like the cruise liner. The effects of the Fascist Business Model are being acutely felt in Italy. Nothing goes without monitor. The credit card companies must report to the fiscal authorities all transactions carried out by Italians, in the country and abroad. Limits have been imposed on bank withdrawals of 10,000 Euros, equal to US$13,000. Cameras have been installed by finance police at the border checkpoints with Switzerland to register all license plates. In addition, currency sniffing dogs have been deployed at the border. The Monti regime can be seen imposing Fascism, plain and simple. Their opening salvo was to attack private capital by raising the capital gains tax. The situation is degrading rapidly. The wealthy of Italy have a new game in removing money from Italy and to escape themselves.

The irony is thick, the tragedy stirring. The Italian cruise liner Costa Concordia went aground, a fitting symbol of the nation of Italy succumbing, a toppled elected regime in a sea of liquidity. Individual decks named after nations went underwater, liquidity of a different type. Parallels between the financial structure and ship structure, along with perceptions and reactions, are interesting. People believing such an accident as incredible in the 21st century need to awaken to reality on the mainland. Italians will make the same comments when their banking system collapses, in the wake of their elected political leadership being dismissed from the helm. The cruise liner was badly off course, as the captain changed paths to salute friends on the nearby island (mistress?). So is the Italian banking sector, hardly alone as the Spanish fleet of banks is also off course, taking on water, the banks derelicts at sea.

The ship crew was not trained for such accident, having advised passengers to return to their cabins incredibly. Neither is the Italian system prepared to handle rough waters, given the most egregious nepotism in all of Europe. Half of million gallons of fuel are being retrieved before salvage operations begin, in an effort to avoid an environmental disaster of contaminated beaches. Contrast to the toxic paper running through the Italian banking system. The ship's insurers may be liable for total costs of about EUR 405 million (=US$500 mn) as a resuilt of standing policies. Unlike the ship liability, the Credit Default Swap contracts, the debt insurance flagships, are forbidden to kick in for awards at docks. The ship's problem might be more low hull draft and high center of gravity ship design, much like the inefficient stream in Italian business practices and the high bank leverage.

THE BIG EVENT IN GREEK DEFAULT

Any bank or credit analyst worth his or her salt expects a Greek Govt Bond default. The event is inevitable, unavoidable, and a certainty. All solutions to date have been patchwork applications of tourniquets and needlepoint stitching, with full acquiescence to the banker class. The concept of a new Euro Bond to supplant the toxic bond is ludicrous, which exhibits the ignorance of the central bankers on conceptual constructs pertaining to monetary matters. The concept of a leaning upon the Intl Monetary Fund for a grand issuance of Special Drawing Rights is again ludicrous. A basket of water-logged debt-soaked currencies does not make for a viable raft to float any bodies in any seas. The contagion from a forced accord on Greek bonds will have a notable fallout value effect to Italian bonds, even to Spanish bonds. If the accord ignores the effect traveling with light speed to Italy, the plan is doomed from the outset. The default in Greece should trigger a Credit Default Swap event and award payments. But decisions might follow the trend seen to date, where contract law is trampled upon. The supposed redefinitions of debt securities were a travesty, not yet sufficiently challenged by the legal warriors and the court system. Then consider that the biggest creditor to Italy lies within the major French banks. A likely collapse of French banks in the wake seems the path that nature will take.

The contagion would spread to the London and New York bank centers, where insolvent hollow banks have stood for three years. They have long lost their credit engine role, thus the economic stalls in reverse gear. Lastly, any solution, apart from a new monetary system, must address the dire need for recapitalization of the Western banking system. The accord must begin with Europe. The accord must begin with $2 trillion or more to rebuild banks. A figure of $5 trillion is floated. The accord must dispose of the entire sovereign debt and its toxic paper from Southern Europe. Expect the greatest event in modern financial history before too many more weeks or months, the sovereign bond default and bank recapitalization. The impact on the USDollar could be profound and life altering for the planet. Expect unfortunately for half measures that sidestep any new monetary system and proper role for Gold. The half measures in the accord will bring great new attention on Gold, which should be at the core of the solution, both in the currency and banking system.

U.S. HOUSING PERMANENTLY CRIPPLED

The US-based shadow home inventory is vastly larger than estimated. The bank owned inventory is enormous, but so is the variation in those estimates. What is certain is the vast overhang of home inventory held by banks, and the steady flow to replenish the hidden inventory tumor, prevent any bottoming process to prepare for any recovery. Accurate housing data is hard to come by. The housing crisis is arguably a national emergency, which crushed both the banking system and the USEconomy. The USGovt-owned Fannie Mae still prevents the public from gaining access to loan data in detail, probably because multi-$trillion fraud is buried. It is far too difficult to obtain data from Freddie Mac also, and the MERS title database remains a black hole. My Jackass loose estimate has been tossed around frequently of one million bank owned homes in inventory, unsold, hanging over the market, rendering clearance and stability an absolute impossibility, with more home seizures always in the pipeline. The market cannot digest such an overhang, and cannot stop the price decline, especially since new foreclosures keep the flow into REO bank inventory. Banks refuse to clear their inventory, and are encouraged to hold that inventory since 0% financing is offered by the USGovt. If the shadow inventory is much larger than one million homes, then housing prices have much farther to go before they hit bottom, which has dire consequences for communities, homeowners, and the broader economy. It also means the US banking system is deader than dead.

On December 21st, less than one month ago, HousingWire reported that CoreLogic projected shadow inventory to be 1.6 million homes throughout the entire United States. Definition of a shadow inventory property varies widely. For example, the Wall Street Journal published an article last November, in which inventory size varied from the CoreLogic higher estimate to about 3 million by Barclays Capital. Other estimates are approximately 4 million by LPS Applied Analytic, roughly 4.3 million by Capital Economics. But the highest calculation comes from the source of most impressive methodology. Laurie Goodman of Amherst Securities offers the estimate of between 8.2 million and 10.3 million homes. Hers is regarded by many experts as having the most carefully crafted model, despite being the most dire of estimates. Michael Olenick of Naked Capitalism has his own large reliable database. He has been on the job in analyzing liability to taxpayers, investors, and banks. He submits his assumptions in calculations, an honorable practice based in integrity. The Olenick analysis arrives at a total close to the Goodman range. Using a more narrow definition of what constitutes shadow inventory, he estimates 9.8 million homes are in bank inventory, or suspended animation within the system, waiting for liquidation, suppressing price further. Long past critical mass, only radical out-of-the-box solutions will work. Massive loan forgiveness is the only solution, but it will never be done. USGovt ownership of one quarter of American homes is more likely. Conclude as inevitable that the nation will soon face widespread bank failures and even more staggering loss in home values, since the overhang of home inventory will force home prices down another 20%, my ongoing estimate that has been repeated and repeated ad nauseum. The problem is so great that the mortgage bond market can no longer be described as having viable parties and counter-parties. Too much bond counterfeit. Too much duplicate income streams used in mortgage bond securitization. Therefore, the principal parties do not want liquidations or scrutiny. See the Naked Capitalism articles (HERE & HERE).

U.S. GDP CALCULATION A TRAVESTY

Grossly Distorted Procedures on GDP calculations must be explained. Both hedonics and imputations contribute to one third of the entire reported Gross Domestic Product. The Chinese have long complained that half of the US GDP is mythical, due to interchange of debt paper across desks. The USEconomy is a fraction of its stated size, and it is stuck in chronic recession. A big hat tip to Michael Shedlock, whose analysis is excellent in focused economic sector topics. He provides an excellent overview on Hedonics and Imputations, to reveal their corruption of thought, whose concoctions he labels Grossly Distorted Procedures. Shedlock wrote, "Hedonics is a way of accounting for the changing quality of products when calculating price movements. For example, today's computers are 2 to 3 times faster and have more memory than models produced just a few years ago. If someone can buy a better computer today than last year for the same price, have not prices really fallen? Here is another example. Is it realistic to compare the price of a 1955 Chevy with the price of a 2005 Toyota with air conditioning, DVD player, anti-lock brakes, seat belts, air bags, side air bags, power steering, power brakes, etc? To say that cars have gone from 1955 prices to 2005 prices and calling the ENTIRE rise inflation is obviously wrong although many inflation alarmists do just that. Sorry folks, but that is not a straight up valid comparison. Would you be willing to drive to work a Model T ford today? If not, then comparisons of car prices today versus 1920 or 1950 or whenever are pretty absurd."

The USGovt makes unilateral decisions on value, in order to offset the rise in production costs from energy and materials, even labor. They justify their methods by pointing to manufacturing efficiency and economies of scale in production. They use the falling technology prices as justification for other abusive methods to reduce prices from inherent value on features which actually are subjected to strong price pressures. Shedlock rightfully points out how the potential greater hedonic abuse has entered into methods applied to the Gross Domestic Product, a mainstay not to be cut out. The accounted size of the USEconomy is subjected to vast distortions in the calculations. As the measured price inflation is kept low by force, the estimated GDP result is lifted higher by the same force. The lie in the CPI has been 6% to 8% for the last few years. That means the GDP has been running consistently negative in the most profound and harmful economic recession in American history. My analysis relies upon the indefatigable work of the Shadow Govt Statistics group. They measure the GDP as one quarter versus the same quarter a year ago to demonstrate a clear downward trend, a chronic recession. Conclude that the US GDP has been in decline by 4% to 6% for consecutive years. Shedlock has reported by means of Bureau of Economic Analysis data, that the US GDP is artificially lifted by a whopping $2.257 trillion in hedonic adjustments, equal to 22% of the entire GDP. That portion of the US GDP is pure myth. The United States is the only major country that hedonically adjusts its GDP, or needs to. The USEconomy is among the weakest in the entire industrialized world from industrial gutting and chronic consumption and pursuit of asset inflation.

The other major abuse is Imputations, a part of GDP calculation that the USGovt fabricates in estimated value where no cash changes hands. The imputation derives from homeowner self-paid rent and checking account services. These are pure fairy tale absurdities. For example, homeowners are assigned an imputed rent, that they pay to themselves as though renters. The BEA treats homeowners as businesses, which pay rent to themselves for the service of shelter. Be sure to know that mortgage payments and property taxes are also accounted for, a double counting process steeped in corrupt accounting. Self-paid homeowner rent tallies a ripe $153.8 billion in imputed rent as part of the GDP calculations. There is more. Free checking account services from banks are not to go without abuse. Self-paid check account services tallies a ripe $335.2 billion in imputed bank services. The beneficiary is in Personal Income data reported by the clownish USGovt stat labs.

Shedlock has reported by means of Bureau of Economic Analysis data, that the GDP is artificially lifted by a whopping $1.635 trillion in hedonic adjustments, equal to 13% of the entire GDP. Shedlock cites the total fabrication folly was a staggering 35% of the reported US GDP in 2003!! See the Global Economic Analysis article (CLICK HERE).

SIMPLE EVIDENCE OF RECESSION

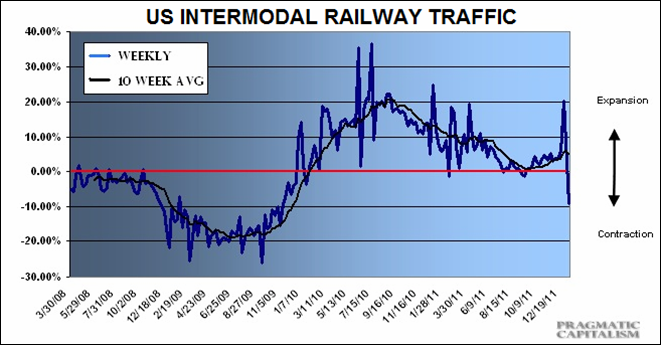

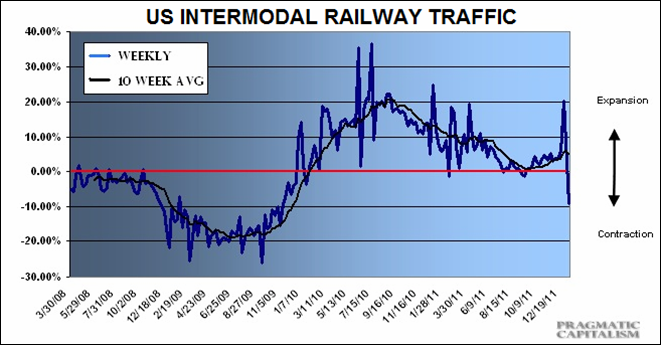

US-based railway traffic is down hard, contradicting the vacant claims of an economic recovery in the United States. The slowdown is across North America, the worst brunt felt in Mexico. The Assn of American Railroads reported intermodal volume for the second week of January totaled 193,812 trailers and containers, down 9.3% versus the same week last year. The Eastern half of the nation was notably slower. The slowdown is across all North America. Canadian railroads reported cumulative volume of 40,281 trailers and containers for 2012, down 9.8% from last year. Cumulative volume on Mexican railroads for 2012 into only January is 10,857 carloads, down 15.2% compared to last year. Conclude that North American is in a severe deep recession, with the worst brunt felt in Mexico. Talk of recovery is Orwellian in its deception. My favorite data series to demonstrate recession is the USGovt payroll tax withholdings. They continue in decline. It is a pure series without adjustment. The USEconomic recession is the New Normal, Mr El-Erian.

CORROSIVE COMEX DRYING UP

Ann Barnhardt confirmed the COMEX is going into obscurity and irrelevance. Players are exiting. Risk of theft is perceived. Trust has gone. Metal inventory will vanish next from honest players in retreat, seeking more legitimate arenas. The normal methods of risk hedging are going away, turning to private means, or quitting altogether. Ann Barnhardt made a huge splash last month in her decision to shut down BCM Capital brokerage firm, for fear that client funds were at great risk of theft. She outlines many carefully laid points. Here are some of her main points with fortified evidence. Notice the point about high frequency trading, which indirectly indicts the GLD & SLV (gold and silver) funds, whose inventory is likely connected to futures arbitrage schemes, as their bullion metal is drained. Notice the perceived spread of futures hedge exposure at the market peripheries. Barnhardt compared events of MFGlobal and JPMorgan to economic treason and betrayal of the American system. Here are some of her main points.

The futures markets are withering and dying on the vine, as business is totally evaporating. Many explicitly state that they are done trading and hedging with futures, both speculators and hedgers.

The volume increases in recent months were due to the veritable fungal infection of the market that is the high frequency algorithm trading systems.

Nobody in the trading pits believes the statistics that come out of the USGovt or the Federal Reserve. Anyone who believes them must be mentally disabled (her words).

Exposure to futures is itself contagious. If producers enter into a private treaty forward delivery contract with a grain elevator or a feedlot, they would still be exposed to the futures market, and to the risk of a futures market collapse, or even just another wealth confiscation. If any contract participant utilizes futures contracts in risk hedge, all parties are exposed. Even private treaty forward contracting is exposed, since someone along the line laid risk off on the futures market.

LONDON TRADER

The London Trader is back with more splendid bountiful information, sharing volumes behind the veil of anonymity. The paper thin COMEX must react to gigantic physical demand, he reports in a recent interview. The staggering Gold demand is creating great shortages in the physical market. Here is the shocker, although it should not come as such a surprise. Compliance departments have widely banned participation in the COMEX anymore. It is drying up as a market. The Chinese have exploited the lower Gold price that resulted from the European distress and the American accommodation. They have grabbed huge physical supply. The anonymous London Trader pitched in a full month after the MFGlobal crime scene cordon tape has been overrun. He opened by describing a compressed coiled spring in both the Gold & Silver markets, from huge physical demand. He actually described the COMEX as no longer a credible marketplace. Gold represents power and the Eastern Hemisphere is gathering in that power. The displacement of Western Gold to Eastern vaults is a major symbol of the Western decline. Here are some of his extreme comments that portray a system entering a collapse phase.

The Big Banks are trying to defend their massive short positions, like with 25 million SLV shorted shares. To meet the silver delivery demands, the cartel is borrowing heavily from the SLV, which will be gradually drained of metal in inventory.

The panic in Europe with a broken system is creating huge Gold demand. The demand for Euro Gold in London is so intense that it brings shock to some veterans. It is creating grand shortages for metal in London. The physical Gold market is being exhausted by European Gold buyers.

The COMEX paper discovery price system has become a joke. No serious players interested in taking physical delivery use the COMEX anymore.

Since the CME did not backstop the MFGlobal clients, entire Compliance Departments prohibit usage of the COMEX. International funds and hedge funds starting in January will go elsewhere, and thus avoid the COMEX.

Expect a powerful move once Gold rises above the $1650 level, as shorts cover in open fear. Above that point look for a very large tranche of unfilled wholesale orders to push the price a lot higher with their bids. The Chinese are Gold buyers at all these prices, $1600, $1700, or $1800. They are buyers, never sellers, and public stories pure nonsense about their retreat.

The Chinese have recently taken another roughly 150 tons away from the Western central banks. The Western central banks essentially donated that Gold in an attempt to prop up their paper currencies. They have exploited the recent pushdown in the Gold price. The Chinese are using Gold accumulation as an indirect maneuver to introduce the Yuan (remninbi) to center stage.

INDICTMENT OF SLV i-TRUST SILVER FUND

The SLV exchange traded fund is drained of silver bars from the back door. Numerous blemishes can be identified. The fund cannot stand scrutiny. It is one of the most effective criminal fraud vehicles ever designed. Thousands of investors have been duped, buying what they believed was physical gold & silver, when they have aided the cartel in suppressing their prices. Their inventory is routinely raided from custodial shorting practices that have become glaringly clear in recent months from simple tracking of inventory and short interest. The SLV fund, formally called the iShares Silver Trust, contains much slippery language in its prospectus. The SLV provides funds for itself and custodian costs (managed by JPMorgan) by selling bullion, from the same fund. They actually achieve a benchmark price target for silver based upon their own sales. Their prospectus carefully states that the SLV share price reflects the value of the trust's silver holdings, NOT the spot silver price. It is a circular practice of self-fulfilling price achievement in suppression efforts.

BrotherJohn gives the excellent analysis in clear understandable terms, with focus on SLV fund shenanigans. A big hat tip goes to him. The SLV fund does not hold sufficient silver bars to correspond to all shares outstanding, but that fraud is carefully permitted under its prospectus and current legal structure. Track the shenanigans in a fine classroom style forensic analysis in YouTube video form by BrotherJohn (CLICK HERE). He covers a wide range of topics. Here are some of his main points. Adam Hamilton, are you paying attention?

The SLV fund has 300 million shares, each worth one ounce of silver, valued at almost $9.0 billion. But it has over 25 million shorted shares, or 8% of the float.

The practice of shorting SLV shares keeps the Silver price suppressed, enabling inventory raids from the fund. Around 25 million shares are short on SLV. Any suspicion that JPMorgan is the predominant party holding short shares would probably be correct, the shares provided by Bank of America, which owns a surprising 22 million shares, always a willing player to help push down the silver price.

The SLV fund rigs their own market, pushing silver to a desired lower price. In fact, the number of silver ounces per share is falling consistently, just over 0.97 oz in recent weeks. Check out September 30th, when the silver price fell hard from 40 to 30 per oz. The SLV fund had numerous big sellers that day in their listing.

A smoking gun is revealed on May 5th, when the silver price was busy falling from 48 to 34 per oz. The SLV fund had a single day volume of 300 million shares on that day in May, equal to its entire float. Conclude that naked shorting was taking place in coordinated fashion with a leveraged arbitrage between the fund and the COMEX using futures contracts. Leverage must be involved. Many fingers point to such arbitrage since the volumes are so great.

The lessons and signals are vividly clear. Purchase and invest in Gold & Silver bars and coins, the mainstay for financial survival and avoidance of debt serfdom. The crisis is working toward a series of climax events stretched over the next year. The outcome will be shocking. The events will awaken the masses finally, who are all too often perplexed and dismayed while many place their heads in the sand. The Gold & Silver prices are heading multiples higher. Efforts to confiscate by government will in all likelihood backfire, raising attention, pointing out value.

Jim

Willie CB is a statistical analyst in marketing research and

retail forecasting. He holds a Ph.D. in Statistics. His career has

stretched over 22 years. He aspires to one day join the financial

editor world, unencumbered by the limitations of economic

credentials. Visit his free website to find articles from topflight

authors at www.GoldenJackass.com

Jim

Willie CB is a statistical analyst in marketing research and

retail forecasting. He holds a Ph.D. in Statistics. His career has

stretched over 22 years. He aspires to one day join the financial

editor world, unencumbered by the limitations of economic

credentials. Visit his free website to find articles from topflight

authors at www.GoldenJackass.com

Any perusal around the world these days features Southern Europe crippled, preparing for the inevitable Greek Govt Bond default. It features a crippled US housing market, a mockery of statistical accounting in the US Gross Domestic Product, the plight of the COMEX with established veterans clearing out desks (not trading), the extreme physical demand reported by the London Trader, and the indictment of the SLV iTrust Silver Fund tool used by the cartel. The survey does not look favorable toward stability. The banking, economic, and political leaders have not pursued reform and remedy in any remote sense. Their only tool left is hyper inflation. The central banks of the Western nations have coordinated Global Quantitative Easing, as the USFed concealed its own QE3. Operation Twist was an enormous ruse, to cover the grand disposal sale (dump) by USGovt creditors and maintain a semblance of stability in the USTreasury market. The global financial crisis continues for a simple reason. No financial reform or remedy has been attempted, only bank-owned bond redemption and colossal aid to the financial sector that controls government ministries and law enforcement. Therefore, the crisis hurtles toward a series of climax events. The Chinese are accumulating physical Gold still in a big way. US finance minister, the diminutive Geithner admitted to the Chinese officials that the USGovt has no more tools left with which to stimulate or lift the USEconomy and its fumbling financial sector. An honest admission, except that hyper monetary inflation remains the all-in-one tool.

The Greek default could trigger some grand unintended consequences. Despite all the planning in the controlled event, likening it to the demolition of a 50-story hotel in an urban center, the better image might be to attempt to hold within a corral 500 cats released from a large truck. In no way can the technocrats, central banks, and bank officials contain the animal spirits coming. The only solution in the end will be the most massive hyper inflation project in history. They must recapitalize the broken banks of Europe, where fallout will surely extend in non-trivial manner to London and New York. Two major pressures will work to lift the Gold & Silver prices. The Commitment of Traders report on commercials points to a significant sequence where they covered their Gold shorts and Silver shorts since the summer months. The road is prepared for a big rise in price after some closing notes are played on the Dollar Death Dance. Details are seen in the January Hat Trick Letter. Also, the acute financial crisis in Europe and the West in general demands some important decisions to manage the Greek default. Look for talk of a monetary solution but action perhaps in a vast recapitalization program for the big banks. A footnote, the Citigroup earnings included a $1.5 billion release from their Loan Loss Reserves. The funds will be needed to cover bond impairment and mortgage related lawsuits. They also had a nice bump in the Credit Value Adjustment, a blatant accounting fraud that exploits gradual impairment to their own corporate bond value. Accounting for banks is a farce.

SOUTHERN EUROPE PERMANENTLY CRIPPLED

Although the entire southern rim is deeply affected, a look at Italy is telling as a microcosm of continental illness. Italy has imposed capital controls on the banks. Movement of funds is being closely monitored. Money cannot be withdrawn in volume at the bank windows. Borders have cameras and registries at the customs checkpoints. Italy has gone fascist with blazing speed, the most blatant indication is the installation of Monti as prime minister. Its banks are ready to capsize, like the cruise liner. The effects of the Fascist Business Model are being acutely felt in Italy. Nothing goes without monitor. The credit card companies must report to the fiscal authorities all transactions carried out by Italians, in the country and abroad. Limits have been imposed on bank withdrawals of 10,000 Euros, equal to US$13,000. Cameras have been installed by finance police at the border checkpoints with Switzerland to register all license plates. In addition, currency sniffing dogs have been deployed at the border. The Monti regime can be seen imposing Fascism, plain and simple. Their opening salvo was to attack private capital by raising the capital gains tax. The situation is degrading rapidly. The wealthy of Italy have a new game in removing money from Italy and to escape themselves.

The irony is thick, the tragedy stirring. The Italian cruise liner Costa Concordia went aground, a fitting symbol of the nation of Italy succumbing, a toppled elected regime in a sea of liquidity. Individual decks named after nations went underwater, liquidity of a different type. Parallels between the financial structure and ship structure, along with perceptions and reactions, are interesting. People believing such an accident as incredible in the 21st century need to awaken to reality on the mainland. Italians will make the same comments when their banking system collapses, in the wake of their elected political leadership being dismissed from the helm. The cruise liner was badly off course, as the captain changed paths to salute friends on the nearby island (mistress?). So is the Italian banking sector, hardly alone as the Spanish fleet of banks is also off course, taking on water, the banks derelicts at sea.

The ship crew was not trained for such accident, having advised passengers to return to their cabins incredibly. Neither is the Italian system prepared to handle rough waters, given the most egregious nepotism in all of Europe. Half of million gallons of fuel are being retrieved before salvage operations begin, in an effort to avoid an environmental disaster of contaminated beaches. Contrast to the toxic paper running through the Italian banking system. The ship's insurers may be liable for total costs of about EUR 405 million (=US$500 mn) as a resuilt of standing policies. Unlike the ship liability, the Credit Default Swap contracts, the debt insurance flagships, are forbidden to kick in for awards at docks. The ship's problem might be more low hull draft and high center of gravity ship design, much like the inefficient stream in Italian business practices and the high bank leverage.

THE BIG EVENT IN GREEK DEFAULT

Any bank or credit analyst worth his or her salt expects a Greek Govt Bond default. The event is inevitable, unavoidable, and a certainty. All solutions to date have been patchwork applications of tourniquets and needlepoint stitching, with full acquiescence to the banker class. The concept of a new Euro Bond to supplant the toxic bond is ludicrous, which exhibits the ignorance of the central bankers on conceptual constructs pertaining to monetary matters. The concept of a leaning upon the Intl Monetary Fund for a grand issuance of Special Drawing Rights is again ludicrous. A basket of water-logged debt-soaked currencies does not make for a viable raft to float any bodies in any seas. The contagion from a forced accord on Greek bonds will have a notable fallout value effect to Italian bonds, even to Spanish bonds. If the accord ignores the effect traveling with light speed to Italy, the plan is doomed from the outset. The default in Greece should trigger a Credit Default Swap event and award payments. But decisions might follow the trend seen to date, where contract law is trampled upon. The supposed redefinitions of debt securities were a travesty, not yet sufficiently challenged by the legal warriors and the court system. Then consider that the biggest creditor to Italy lies within the major French banks. A likely collapse of French banks in the wake seems the path that nature will take.

The contagion would spread to the London and New York bank centers, where insolvent hollow banks have stood for three years. They have long lost their credit engine role, thus the economic stalls in reverse gear. Lastly, any solution, apart from a new monetary system, must address the dire need for recapitalization of the Western banking system. The accord must begin with Europe. The accord must begin with $2 trillion or more to rebuild banks. A figure of $5 trillion is floated. The accord must dispose of the entire sovereign debt and its toxic paper from Southern Europe. Expect the greatest event in modern financial history before too many more weeks or months, the sovereign bond default and bank recapitalization. The impact on the USDollar could be profound and life altering for the planet. Expect unfortunately for half measures that sidestep any new monetary system and proper role for Gold. The half measures in the accord will bring great new attention on Gold, which should be at the core of the solution, both in the currency and banking system.

U.S. HOUSING PERMANENTLY CRIPPLED

The US-based shadow home inventory is vastly larger than estimated. The bank owned inventory is enormous, but so is the variation in those estimates. What is certain is the vast overhang of home inventory held by banks, and the steady flow to replenish the hidden inventory tumor, prevent any bottoming process to prepare for any recovery. Accurate housing data is hard to come by. The housing crisis is arguably a national emergency, which crushed both the banking system and the USEconomy. The USGovt-owned Fannie Mae still prevents the public from gaining access to loan data in detail, probably because multi-$trillion fraud is buried. It is far too difficult to obtain data from Freddie Mac also, and the MERS title database remains a black hole. My Jackass loose estimate has been tossed around frequently of one million bank owned homes in inventory, unsold, hanging over the market, rendering clearance and stability an absolute impossibility, with more home seizures always in the pipeline. The market cannot digest such an overhang, and cannot stop the price decline, especially since new foreclosures keep the flow into REO bank inventory. Banks refuse to clear their inventory, and are encouraged to hold that inventory since 0% financing is offered by the USGovt. If the shadow inventory is much larger than one million homes, then housing prices have much farther to go before they hit bottom, which has dire consequences for communities, homeowners, and the broader economy. It also means the US banking system is deader than dead.

On December 21st, less than one month ago, HousingWire reported that CoreLogic projected shadow inventory to be 1.6 million homes throughout the entire United States. Definition of a shadow inventory property varies widely. For example, the Wall Street Journal published an article last November, in which inventory size varied from the CoreLogic higher estimate to about 3 million by Barclays Capital. Other estimates are approximately 4 million by LPS Applied Analytic, roughly 4.3 million by Capital Economics. But the highest calculation comes from the source of most impressive methodology. Laurie Goodman of Amherst Securities offers the estimate of between 8.2 million and 10.3 million homes. Hers is regarded by many experts as having the most carefully crafted model, despite being the most dire of estimates. Michael Olenick of Naked Capitalism has his own large reliable database. He has been on the job in analyzing liability to taxpayers, investors, and banks. He submits his assumptions in calculations, an honorable practice based in integrity. The Olenick analysis arrives at a total close to the Goodman range. Using a more narrow definition of what constitutes shadow inventory, he estimates 9.8 million homes are in bank inventory, or suspended animation within the system, waiting for liquidation, suppressing price further. Long past critical mass, only radical out-of-the-box solutions will work. Massive loan forgiveness is the only solution, but it will never be done. USGovt ownership of one quarter of American homes is more likely. Conclude as inevitable that the nation will soon face widespread bank failures and even more staggering loss in home values, since the overhang of home inventory will force home prices down another 20%, my ongoing estimate that has been repeated and repeated ad nauseum. The problem is so great that the mortgage bond market can no longer be described as having viable parties and counter-parties. Too much bond counterfeit. Too much duplicate income streams used in mortgage bond securitization. Therefore, the principal parties do not want liquidations or scrutiny. See the Naked Capitalism articles (HERE & HERE).

U.S. GDP CALCULATION A TRAVESTY

Grossly Distorted Procedures on GDP calculations must be explained. Both hedonics and imputations contribute to one third of the entire reported Gross Domestic Product. The Chinese have long complained that half of the US GDP is mythical, due to interchange of debt paper across desks. The USEconomy is a fraction of its stated size, and it is stuck in chronic recession. A big hat tip to Michael Shedlock, whose analysis is excellent in focused economic sector topics. He provides an excellent overview on Hedonics and Imputations, to reveal their corruption of thought, whose concoctions he labels Grossly Distorted Procedures. Shedlock wrote, "Hedonics is a way of accounting for the changing quality of products when calculating price movements. For example, today's computers are 2 to 3 times faster and have more memory than models produced just a few years ago. If someone can buy a better computer today than last year for the same price, have not prices really fallen? Here is another example. Is it realistic to compare the price of a 1955 Chevy with the price of a 2005 Toyota with air conditioning, DVD player, anti-lock brakes, seat belts, air bags, side air bags, power steering, power brakes, etc? To say that cars have gone from 1955 prices to 2005 prices and calling the ENTIRE rise inflation is obviously wrong although many inflation alarmists do just that. Sorry folks, but that is not a straight up valid comparison. Would you be willing to drive to work a Model T ford today? If not, then comparisons of car prices today versus 1920 or 1950 or whenever are pretty absurd."