Thursday, June 30, 2011

World production of gold, 2011

I. The major gold producing countries in 2010.

China gold production is increasing for the eleventh consecutive year. China is the world largest gold producer for the third time in history with 345 tons of gold produced this year. Furthermore among the gold-producing countries, China, with its increasing gold production, seems to go against the general trend.of decreasing gold production. China has already announced that its gold production is expected to increase up to 400 tonnes within the next three years.

Australia is the world second largest gold producer with a gold production of 255 tonnes in 2010 (+15%). However this remains 20% below its level of production of 1998.

The U.S. production of gold has been declining since 1998 (-37%) until it has stabilized around 230 tonnes/years in the last 4 years.

Gold production in South Africa on the other hand continues to decline. Until 2006, this country was the world top producer but after almost a century of hegemony,its ranking declined to the second position in 2007 and fourth in 2010. Gold production in South Africa has decreased by 80% within the last 40 years. It is however interesting to point out that the 2010 Chinese gold production represents only a third of the South African production in the late 60 ...

Russia maintains its gold production at the same level; about 190 tonnes .

Gold production in Peru is still below its peak production of 2005 (208 tons of gold) with 170 tonnes of gold produced in 2010. Although one can identify more than three hundred mines and gold producers in Perou, more than half of the production comes from two major gold mines (22% in 2010) located in a gold mining region of the Amazon rainforest ( 4% in 2010).

Indonesia produced 120 tons of gold in 2010, -27% since its peak production in 2006. Half of it, is produced by one single company which production has declined by 7% in 2010.

Canada remains well below its level of production of 1941 (166 tons of gold) and 1991 (177 tons of gold) with 90 tonnes of gold produced in 2010.

The share of small gold-producing countries (Argentina, Bolivia, Brazil, Chile, Colombia, Ghana, Kazakhstan, Mali, Mexico, Morocco, Uzbekistan, Papua, Philippines, Tanzania, ...) accounts for more than a third of the world gold production in 2010 against less than 10% in 1969. To find new deposits of gold, mining companies must go deeper in hostile territories such as deserts, rainforests and polar region to find the last remaining gram of gold.

II. Production peak or just the end of a cycle?

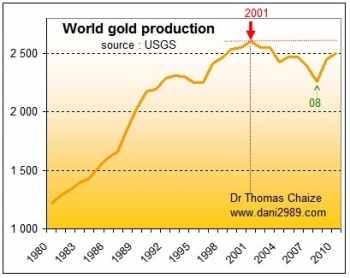

Both in 2009 and in 2010, I announced the possibility of a temporary increase of the world gold production as a result of lower production costs due to 2008 crisis effects. I also confirmed you the peak of gold production in 2001. Since then, global production increased by 240 tonnes reaching 2 500 tonnes in 2010.

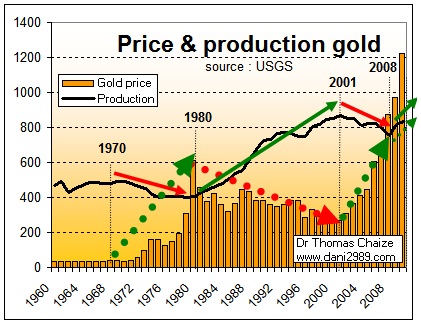

It is now legitimate to question the sustainability of this increase in the world gold production. In 1980, in a similar situation, when gold production increased, it brought down the price of gold during 20 years.

1: From 1970 to 1980 there has been a decline and then a stagnation in the world gold production resulting in higher gold price (positive divergence). The price was too low for several decades, forcing some gold mines to close as production costs were above the selling price.

Then from 1980 to 2001, for 20 years, the gold world production has increased resulting this time in a decrease of the gold price (negative divergence). Gold mines were producing more in order to compensate for the price decline from $ 850 to less than 250 dollars an ounce ...

2: From 2001 to 2008, we had a decline in gold production and higher prices from 2008 to 2010 (positive divergence). Gold production decreased by 340 tonnes while the gold price has tripled. The prices were too low to encourage the opening of new gold mines as well as exploration.

Since 2008, both the gold production and its price on the market has been evolving in the same direction. Usually in this case, as a "normal" cycle, we should eventually be in an oversupply situation and therefore worry for the market price of an ounce of gold. The increase in the price of gold for the last 10 years should lead to overproduction and inevitably to a reduction of the price (negative divergence). This should then be followed by a reaction of gold mining companies which would open new gold mines, producing more as well as exploring new areas.

But since 2001, the old models of cycles are obsolete, since gold has already reached its production peak. We are now in a sort of super cycle "terra incognita".

Production costs were slightly and temporarily stabilized in some gold producing countries after the 2008 crisis. With the slight decrease (or stabilization) of production costs for gold mines and the increase of gold price,we observe a temporary increase in the world gold production.

But this is a pause and not a change of trend, structurally nothing has changed. Within 1 to 3 years, the world gold production will decline again, just because no country will be able to produce 1000 tons of gold like South Africa did in the 60s.

III. Gold production in 2010, 2020 and 2030.

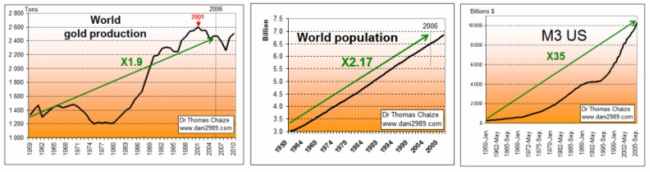

Gold production has increased by a factor 2.1 from 1959 to 2010. At the same time, the world population has been multiplied by a factor 2.2. Thus we produced more or less the same amount of gold per inhabitant as in 1959.

When one does the ratio of the gold world production and the world population, we can see that gold production was of about 0.36 grams per inhabitant in 2010, which is close to the average over the last 100 years (0.37 grams). According to estimation the world population should reach 7.2 billion in 2020 and 8.2 billion in 2030. This should indicate us a "necessary" gold production of 2803 tonnes in 2020 and 3034 tons in 2030. In the short term (1 to 3 years) as discussed previously, the world gold production could still increase slightly, but in the next 10 or 20 years it will definitely decrease because of the number of good quality gold reserve. A difference will appear between the increase in the world population and the decline of the gold production. The world will produce less gold with a growing population and an exponatial growth of the money supply.

U.S. money supply, M3, has increased by a factor 35 only between 1959 and 2006 (since March 2006 the U.S. federal bank does not communicate the amount of dollars printed).

We reach a point where the growth of the world population and the exponential growth of the money supply remains strong, while the growth of the gold production is seriously threatened. According to King Hubert, for whom the coexistence of the monetary system and resources is only possible when both systems keep pace:

" We are in a crisis in the evolution of human society. It is unique in both human and geologic history. It has never happened before and it can not possibly happen again. You can only use oil once. You can only use metals once. Soon all the oil is going to be burned and all the metals mined and scattered "

"And the time scale is not centuries, it's decades" February 1983 " Geophysics magazine".

Dr Thomas Chaize

Africa is the Prize

Violence back on in Cairo's Tahrir Square

Greeks continue to resist the Banksters

The Greek government last night passed the harsh austerity package on which its continued international funding depends, offering the nation and the euro zone a brief respite from crisis.

It faces a second, more complex vote tomorrow on laws to enforce the measures.

Observers warned that implementing the austerity program would be difficult, meaning the vote had bought breathing space but an eventual Greek default remained likely.

Wednesday, June 29, 2011

Silver and Copper to fight disease

Athens becomes the new Cairo

Lagarde confirmed as new IMF boss

Keiser Report: Waterboard Bernanke Again!

This week Max Keiser and co-host, Stacy Herbert, report on scrapyards being the new pawn shops, Chinese ground troops marching on D.C. and the real British bank exposure to bad Greek debt. In the second half of the show, Max talks to Leah McGrath Goodman about her new book: The Asylum: The Renegades Who Hijacked the World's Oil Market.

Tuesday, June 28, 2011

Italy government tensions rise over austerity plans

From Reuters:

From Reuters:Tensions increased in Italy's government on Sunday over an austerity plan to be approved next week, with one senior coalition member accusing Economy Minister Giulio Tremonti of trying to cause the government's collapse.

Defense Undersecretary Guido Crosetto told news agency ANSA he was "fed up" with Tremonti's autocratic style, saying he was imposing indiscriminate cuts on every ministry but his own.

"It's clear that the economy minister just wants to find a way to upset everything and bring down the government," said Crosetto, a former economic spokesman for Prime Minister Silvio Berlusconi's People of Freedom (PDL) party.

The austerity budget aimed at eliminating the budget deficit in 2014 is due to be approved by the cabinet on Thursday, following a meeting of ruling coalition leaders on Tuesday to find political agreement over the measures....read on

Libyan update: NATO 'trying to kill Gaddafi'

From The UK Telegraph:

From The UK Telegraph:In the first such admission, Adm Samuel Locklear, commander of the NATO Joint Operations Command in Naples, said that efforts had been stepped up to target the Libyan leader, despite declarations by the Obama administration that "regime change" was not the goal.

The admiral's comments were revealed by Representative Mike Turner, an Ohio Republican and member of the House Armed Services Committee.

Mr Turner has opposed the military intervention from the outset was among those who voted in the House of Representatives last week to deny President Barack Obama the authority to wage war against Libya.

Another motion to stop funding for the war failed.

He told Foreign Policy magazine that he came away from his conversation with Adm Locklear convinced that Nato was acting beyond remit of the United Nations 1973 resolution on Libya, which allowed for enforcement of a no-fly zone and the defence of civilians and against Col Gaddafi's forces......read on

Monday, June 27, 2011

Lindsey Williams - "Game Over"

Syrian update

Drachma return talk 'immense stupidity'

Perhaps the Fat Cats in the Greek Parliament could set an example for the benefits of an austere life, but then again they might just get eaten if the drachma makes a come back.

Perhaps the Fat Cats in the Greek Parliament could set an example for the benefits of an austere life, but then again they might just get eaten if the drachma makes a come back.From The Sydney Morning Herald:

Greece's Deputy Prime Minister Theodoros Pangalos has blasted suggestions that it would be better for his country to abandon the euro and return to the drachma as an "immense stupidity".

"Those who say this are extremely stupid. While they may be analysts, university professors or economists, saying that is an immense stupidity," Pangalos told daily Spanish newspaper El Mundo.

Debt-wracked Greece has been told by European peers that it cannot hope to continue receiving aid from a 110-billion-euro ($148.9 billion) rescue package agreed with the EU and the IMF last year without biting budget reforms and privatisations.

Greece's Deputy Prime Minister Theodoros Pangalos has blasted suggestions that it would be better for his country to abandon the euro and return to the drachma as an "immense stupidity".

"Those who say this are extremely stupid. While they may be analysts, university professors or economists, saying that is an immense stupidity," Pangalos told daily Spanish newspaper El Mundo.

Debt-wracked Greece has been told by European peers that it cannot hope to continue receiving aid from a 110-billion-euro ($148.9 billion) rescue package agreed with the EU and the IMF last year without biting budget reforms and privatisations.

Advertisement: Story continues below

The Greek parliament will vote on an austerity package this week but some economists have argued that Athens needs to restructure its debt and leave the euro to become economically competitive again.

"Returning to the drachma would mean that on the following day banks would be surrounded by terrified people trying to withdraw their money, the army would have to protect them with tanks because there would not be enough police," said Pangalos.

"There would be riots everywhere, shops would be empty, some people would throw themselves out the window ... And it would also be a disaster for the entire European economy."

Read more: http://www.smh.com.au/business/world-business/drachma-return-talk-immense-stupidity-20110627-1gmwu.html#ixzz1QSbmJNoa

Why are Greeks buying gold?

From The Daily Mail:

From The Daily Mail:To many modern economists it must seem an irrational response, about as helpful as marching to the top of the Acropolis to pray for the assistance of the goddess Athena.

In fact, it is the most practical course that the unfortunate Greeks can take as individuals.

In the present situation of the Greek economy, gold is the most likely unit of exchange to survive the currency crisis and maintain its purchasing power, particularly if Greece has to leave the Eurozone.

Greece will probably be forced into default. If there is a default in Greek bonds, it may well involve a rise in the gold price as the bonds fall in value

There are historic examples. In June 1940, at the time of the fall of France, refugees headed south en masse - away from the German tanks and towards those parts of the country which were still in French hands.

When they went to buy petrol, they found no one would accept their francs, though they were still legal tender. The petrol stations would, however, still sell fuel to those French peasants who had kept their money in gold coins.

Greece will probably be forced into default. If there is a default in Greek bonds, it may well involve a rise in the gold price as the bonds fall in value.

There is also then likely to be a rise in the price of gold in terms of the euro, the dollar, the yen and the pound. An investor in gold will not only maintain the value of his investment, but make a profit.

One of the historic functions of money is to serve as a store of value. Quite a number of commodities have been a good store of value over long periods of time. That has been true of farmland, which has, with fluctuations, maintained its real value for 300 years or more. That has, among other things, helped individual farmers to trade on a constant capital.

Yet farmland, useful as it is as a stable asset, is not liquid, unlike such metallic currencies as gold and silver. Farmland cannot be assumed to be immediately available for purchase or sale: for example, a farmer may have to wait for a neighbouring farmer to retire or die. Yet gold or silver can be sold immediately in almost any part of the world at a readily ascertained current price.

For traders, liquidity is an essential virtue in any form of money. However, the combination of liquidity and real value is almost unique to metallic currencies.

But they have a further highly significant advantage. Paper currencies are issued by governments and central banks. The dominant currencies of the past two centuries were the pound and then the dollar. One can see how little security they give from the mottos printed on their notes.

The ten-pound note offers as its underlying security the statement: 'I promise to pay the bearer on demand the sum of ten pounds,' signed by the Chief Cashier.

The dollar, rather more frankly, observes: 'In God We Trust.' Neither the Chief Cashier, nor God Himself, is in any position to offer such a guarantee.

The truth is paper currencies are only worth the paper on which they are printed, and sometimes not even that.

Read more: http://www.dailymail.co.uk/debate/article-2008068/WILLIAM-REES-MOGG-The-Greeks-buying-gold--you.html#ixzz1QQ9zZkH9

BIS Says Gold Held in Swap Contracts Rose 18%

Why anyone, let alone a country, would swap Gold, a stable form of money for over 5,000 years, for access to a few more computer generated zeroes of fiat currency on statement or balance sheet is beyond me.

Why anyone, let alone a country, would swap Gold, a stable form of money for over 5,000 years, for access to a few more computer generated zeroes of fiat currency on statement or balance sheet is beyond me.From Bloomberg:

The Bank for International Settlements held 409 metric tons of bullion related to gold swaps contracts as of March 31, up 18 percent from a year earlier.

The BIS held 346 tons of gold in connection with swap operations through March 31 last year, the Basel, Switzerland- based bank said in its annual report today. Under swap contracts, the bank exchanges currencies for physical gold, which it must return at the end of the contract.

The bank’s gold investment assets stood at 119 tons, down from 120 tons a year earlier, it said......read on

Sunday, June 26, 2011

How Silver is Like Oil: An Upcoming Explosion

By Dr. Jeffrey Lewis:

By Dr. Jeffrey Lewis:As prices at the pump move toward $4 and even $5 per gallon, there is no shortage of people calling for new regulations in finance. Frequently blamed on “speculators,” high prices at the pump are, as some politicians say, the result of lax laws.

But can it really be speculators that are driving up the price of oil? Without question, anyone can drive up the price of anything for a very temporary amount of time. Following the rise, though, one has to wonder why any single oil company wouldn’t come to the market with more oil than they were producing at lower prices.

Oil vs. Silver

Once past the stagflationary 1970s, oil prices were reasonable all the way up until the 2000s. Through the 1990s, the American family enjoyed driving their minivans all around town with gasoline no more than $.80 a gallon.

But we have to wonder why those days are gone. Why won’t gasoline ever come back to $.80 a gallon? It’s because the cheap oil is gone; the cheap silver is soon to be gone, too.

Throughout recent history, governments have subsidized energy consumption and production. We consumed too much because it was too cheap, and now that all the easily found oil has been brought to the surface, the only oil remaining is harder to find and more expensive to produce.

We should wonder if the same general trend is not in store for silver. Having been manipulated in price by large banking interests on the futures markets, silver was far too cheap through the 1990s and even the 2000s. Now into the second decade of this new millennia—a decade more dependent on electronics than any other in history—we should wonder if this will be the ten years that lead silver to a new boom in line with that of oil’s historical rise.

This is the very obvious problem in subsidizing the use of any finite commodity, directly or indirectly. Subsidies for oil kept production high, even when it made little sense. New subsidies for other energy forms are eating away at global food supplies, as producing ethanol is more valuable politically than feeding the many people around the world who starve due to shortage. Decade-long suppressions on silver prices (luckily, most price suppression happened when we consumed the least of it) will only stand to send silver higher as we consume more of it.

What the future holds

Anyone knows that the future will be more electronic than the past. And the explosion in computing and personal devices won’t just be in the developed world—no, the low price of components (save for silver) means that all 7 billion of the world’s inhabitants will experience the technological revolution.

The tech revolution couldn’t come at a better time for silver investors. Just as it is realized how much silver was wasted in the past, we can only look to a future which contains far more above ground silver and far less silver below the surface.

Dr. Jeffrey Lewis, in addition to running a busy medical practice, is the editor of Silver-Coin-Investor.com

Less is More

Have pillowcase will travel

Interesting to note the difference in treatment between Australian, Julian Assange who is under house arrest even though he has not been charged with a crime vs. the former Egyptian Finance Minister who has been sentenced to 30 years jail in Egypt yet is free in the UK. He must have fled with a few of those golden pillowcases.

Saturday, June 25, 2011

Greek islands feel pinch of debt crisis

101 East: On the borderline

James Turk goes Austrian

Phil Streible discusses the metals futures markets

Pouring Oil on troubled waters

Maybe Barry missed the first lesson in Economics 101. The cure for high commodities prices is high prices (encourages new supply, curbs demand), the cure for low prices is low prices (encourages use, discourages discovery). Ying and Yang. Same goes for capital, pay low returns it will flee to where it is welcome, see the USD:AUD exchange pair chart for the last 10 years.

Maybe Barry missed the first lesson in Economics 101. The cure for high commodities prices is high prices (encourages new supply, curbs demand), the cure for low prices is low prices (encourages use, discourages discovery). Ying and Yang. Same goes for capital, pay low returns it will flee to where it is welcome, see the USD:AUD exchange pair chart for the last 10 years. From The Korea Herald:

NEW YORK (AP) ― The United States and other nations that depend on oil imports will release and sell 60 million barrels of crude from emergency stocks in an effort to ease the strain of high oil prices on the global economy.

The release by the International Energy Agency, a group of more than two dozen countries, covers only what the world uses roughly every 16 hours. But it was enough to send oil prices lower, at least for the moment.

In addition to helping the struggling economies of the U.S. and Europe, analysts said the move was meant as a rebuke to OPEC, which has refused to increase oil production to bring down prices.

It will be the largest sale of crude ever from world strategic reserves and only the third since the IEA was formed in 1974 after the Arab oil embargo. The IEA released oil in 2005 after Hurricane Katrina and in 1990 and 1991 after Iraq invaded Kuwait.

Half the oil will come from reserves in the U.S. Refiners who turn crude into gasoline will be able to bid on the extra oil and have it shipped to them from the salt caverns along the Gulf Coast where it is stored.

The IEA said high oil demand and shortfalls of oil production caused by unrest in the Middle East and North Africa threatened to “undermine the fragile global economic recovery.”

The uprising in Libya has taken 1.5 million barrels of oil per day off of the market ― half a million barrels less than will be released each day by the IEA for 30 days.

The price of oil rose to nearly $114 per barrel in at the end of April, the highest since the summer of 2008, has fallen 20 percent since then to about $91 a barrel on Thursday. Analysts questioned how much relief the move would provide the economy, and for how long.

One analyst, Andrew Lipow, said the timing of the announcement, a day after Federal Reserve Chairman Ben Bernanke delivered a negative outlook on the economy, suggests that industrialized countries are grasping for solutions. He said Americans should expect the price of gasoline to fall, but not dramatically, in coming weeks.

“Fifteen or 20 cents a gallon of relief is not enough to make people feel good about their job prospects or losses on the stock market or our general economic slowdown,” he said.

The IEA and the White House said they were acting to increase the supply of oil available during the peak summer driving season.

“We are taking this action in response to the ongoing loss of crude oil due to supply disruptions in Libya and other countries and their impact on the global economic recovery,” Energy Secretary Steven Chu said.

Gas prices have already fallen for 20 days in a row. They were down another penny Wednesday, to a nationwide average of $3.61 per gallon, according to the AAA Daily Fuel Gauge Report. That’s about 21 cents lower than a month ago. Gas prices peaked this year at a national average of $3.98 per gallon in early May.

The timing of the release brought criticism from business groups and Republican lawmakers, who accused President Barack Obama of playing politics with the country’s oil reserves, which are intended to address emergencies.

The amount of oil to be released, 2 million barrels per day, represents 2.2 percent of daily global oil demand. The 60 million barrels to be released over the span of a month is less than one day’s demand, about 89 million barrels.

The IEA left open the possibility that it could continue the program after a month.

The IEA’s move comes two weeks after OPEC, the Organization of Petroleum Exporting Countries, decided during a tense meeting not to increase oil production to meet rising demand. OPEC is made up primarily of Middle Eastern and North African nations.

OPEC countries are divided over whether to increase supply. Iran and Venezuela want to keep production stable in hopes of keeping prices ― and revenue ― high. Saudi Arabia wants to increase production, fearing that high oil prices will hurt the global economy and reduce oil demand over the long term.

The head of the IEA, Nobuo Tanaka, expressed disappointment about OPEC’s decision after that meeting. At a news conference Thursday in Paris, he said the IEA’s action would “contribute to ensuring that adequate supplies are available to the global market.”

Kevin Book, an analyst at Clearview Energy Partners, said the move was the first time the IEA has used its reserves as an offensive weapon “to send an unforgettable message to OPEC.”

The reserves, he said, have always acted as a shield. “Now we are using it to bludgeon prices globally. This is the first time we’ve used our shield as a club.”.......read on

Friday, June 24, 2011

John Embry - The US will default on its debt

John Embry discusses the eventual default on the US debt and the Greece crisis with Eric King of King World News.....listen here

Weekend Chillout

Black Swans from New Normal

By Jim Willie:

By Jim Willie:Mohammed El-Erian is given credit for the phrase 'The New Normal' to mean an altered state of perceived instability within the normalcy realm, as in crisis being called normal, like endless crisis. As buddy Jim Mess in Europe says, just like trying to redefine what debt default is, it sounds like high octane prevarication. El-Erian is considered one of the good guys. He served capably at Harvard University on the management team of the giant multi-$billion endowment fund. At PIMCO, he worked on the team to direct the biggest bond fund in the world to turn its back on the entire USTreasury Bond complex. In fact, their Total Return Fund, its flagship bond fund, is net short on USTreasurys as a group. That means they own a raft of Credit Default Swaps for USGovt debt default and an assortment of other vehicles like the TNX and TYX that track the 10-year and 30-year bond yield. They recognize an asset bubble when they see one, and even invest in Gold.

The other person relevant to the article title is Nassim Taleb, who coined the term Black Swan. Generally it refers to the extreme oddity that passes through view, shows up on the radar, the extreme warning signal being dire, but is largely ignored by the masses, regarded as the exception or outlier event. THE BLACK SWAN HAS BECOME THE NATIONAL BIRD!! When a few black swans appear, the alert analysts pay heed and express their warnings. When an armada of black swans appear, the message is clear. A systemic failure is in progress, and the important foundations are crumbling. In 2009 and 2010, it was clear that numerous black swans were sighted and identified. In 2011, something highly unusual and extraordinary has occurred. The black swans can be organized into groups. They are numerous within each important economic and financial camp. The Armada of Black Swans, well organized into regiments, has become dominant enough to be considered the New Normal. During the global financial crisis (which has earned a widely used GFC acronym), tragically the state of crisis has become an engrained latticework on the reality mosaic. A quick review at a high level should cause alarm, except for the gradual pathogenesis that dictates the pace of systemic failure in progress. If the list below were presented as a Wall Street Journal forecast in 2006, the author would have been subjected to laughter, derision, and mockery. Yet here and now, the organized groups of black swans are visible everywhere one looks. Worse, they are carrying nuclear slingshots, and excrete highly toxic green blobs into the liquidity streams that we have grown so dependent upon.

QE TO INFINITY

Quantitative Easing will continue for obvious reasons. Many were outlined in the last two articles. The QE2 will continue seamlessly, extending beyond the June 30th deadline. It will change in complexion slightly to become QE3, with some added twists like to include some municipal bonds. Later the entire financial initiatives will morph into a Global QE, since all major central banks will face the same plight. They will all purchase USTreasury Bonds or face extinction, in order to support their own balance sheets. The credibility of the US Federal Reserve has undergone major damage. In the next year, it will be totally destroyed. The factor ignored by many analysts is that the USFed balance sheet has expanded recklessly, and insolvency is its unavoidable condition. If the US housing market does not revive, then the US banks will go deeper into insolvency, carrying perhaps two million homes on their books at some point in the future. The resulting effect on the USFed balance sheet is permanent ruin. The USFed does have owners, and they cannot be pleased. The turnaround in the housing market never occurred. Its prospects look worse with each passing month. If the USGovt or the Elite operating as handlers for the captive USGovt decide to convert private property into collectivized syndicate ownership, and use their Fannie Mae device as agent for the process, then perhaps the USFed might serve as a facilitator to the vast Collectivism project. The United States Government might someday own the majority of homes in the nation, maybe even commercial buildings and shopping malls too. The disenfranchised can always go camping, guided by a emergency team.

ARMADA OF BLACK SWANS

Consider the following black swan specimens, each of which is astounding, each alarming, each serving as one more added element to the ruined situation. The swan organization is admittedly rough, but the regiments are put in sensible order. Any small handful of these signals would qualify as forewarning a profound crisis. Not anymore, since crisis is the new normal. Not anymore, since black swans adorn the entire landscape. A healthy white swan gradually suffers from toxic exposure, quickly to turn black from a fast acting decay process. Apologies for overlooking at least a dozen other important other black swans, as time and space did not permit the exhaustive catalogue process. Emphasis was given to the United States ponds and its migratory bird population.

USTREASURY BOND SWANS

- USGovt debt ceiling standoff, with actual violations

- Over 75% of USTreasurys auctioned bought by the USFed in debt monetization

- Turnaround from primary bond dealers to POMO repurchase by the USFed is 3 weeks

- Foreign banks form 12 of 21 primary bond dealers

- PIMCO owns no USTreasury Bonds, even short

- Global boycott of USTBond by creditors, some net sellers

- Foreign creditors owns the majority of USGovt debt

- A fixture of $1.5 trillion annual USGovt deficits

- Greenspan and David Stockman warn of USGovt debt catastrophe

- USMint officers admit Fort Knox has been shut down for 30 years, as in zero gold

USFED SWANS

- QE permanence, otherwise called QE to Infinity, worked into standard policy

- Bank of England urges more bond buying

- Cost of money 0% for two full years, implication being destroyed capital

- Chairman regards monetary hyper-inflation as being zero cost

- Ron Paul pushes for a USFed audit, an end run to pay down USGovt debt

- USFed owns more USTBonds than any other creditor

- Competing Currency War has Euro weakness mean USDollar as all circle the toilet

USGOVT SWANS

- USGovt could shut all operations but still be have a budget deficit

- USGovt could confiscate all income but still have a budget deficit

- USGovt must cover AIG payouts on Greek Govt debt default from CDSwaps

- US Postal Service stops all payments into their pension system

- New York Fed refuses to disclose the destination of $6.6 billion missing from Iraqi Reconstruction Fund

- Federal Worker Pension Funds and G-Funds confiscated (called borrowed)

- USMint runs out of gold & silver metal to make coins

COMEX SWANS

- GATA Gold Rush 2011 in London Savoy Hotel on August 4th will feature the COMEX whisteblower Andrew Maguire

- Silver futures contracts settled almost exclusively in cash, often with 25% vig bonus

- Gold & silver futures contracts often settled with GLD & SLV shares

- Umpteen margin increases for gold & silver futures contracts, but reductions in USTBond futures contract margin requirements

- Brent versus West Texas crude oil price has a $20 spread

- Every time Bernanke assures US financial markets, gold & silver rise in price

- Elimination of Over The Counter gold & silver contracts due in mid-July

BANK SWANS

- Chronically insolvent USFed and EuroCB, balance sheets ruined

- FASB accounting rules permit banks to grade their own test exams

- Stress Test for banks had almost no stress, a sham

- Shadow housing inventory held by banks over one million homes

- Wall Street firms in court on the defensive, JPMorgan foreclosed soldiers

- Wall Street firms banned in Europe on bond securitization and issuance

- Strategic mortgage defaults by homeowners on the fast rise

- Gold holdings by tyrant Arab rulers targeted by New York & London banks

- War over Libya grabbed $90 billion in Qaddafi money by New York & London

- PIGS sovereign debt default in Europe to have impact ripples that reach US banks

- Standard & Poors reminds the players what constitutes a debt default

- No liquidation of big US or London or European banks since Lehman Brothers

- Much of dull US population believes the propaganda that Gold is a bubble

USECONOMY SWANS

- USEconomic indexes fall off the cliff, see Philly Fed, Empire State, ISMs

- Rampant systemic insolvency in banks, homes, federal government

- US housing resumes its powerful bear market

- US land title system in the disintegration process, see MERS on mortgage titles

- Unemployment at 20% across the Western world, economic misery index hit 30%

- USGovt economic stimulus never contains stimulus

- Shrinking US trucker industry from $4 gasoline and diesel

- China begins to export price inflation to the United States

- Killing state worker union pensions as part of the state budget shortfalls

- Gulf of Mexico off limits for oil drilling

- 1 in 7 Americans is on Food Stamps, whose debit cards are good JPMorgan business

FOOD & WEATHER SWANS

- Food price inflation is staggering but denied

- Floods across Midwest & Plains states to interrupt with planting & harvest

- Australian floods have interfered with coal industry and agriculture

- Big volcanoes like in Chile and Iceland disrupt weather and air travel

EUROPEAN SWANS

- German bankers at war with Euro Central Bank

- Germans abandon the EuroCB, leaving it to Goldman Sachs, see Draghi

- Spanish banking system has yet to write down much on housing credit assets

- Portugal, Italy, and Spain sure to follow Greece into a debt default

- Belgium has had no government for a full year

- Ireland prints more money per capita than the USFed

CHINESE SWANS

- G-8 Meeting is pushed aside, as the Anglos deal with broad insolvency

- G-20 Meeting takes center stage in a power play, led by China and the BRICs

- China buys discounted PIGS sovereign debt, to redeem later in central bank gold

- Chinese FX reserves exceed $3 trillion held in sovereign wealth funds

- China owns most world major ports, as part of a strangulation process

- China conducts the great Idaho experiment, toward re-industrialization of America

HIDDEN SWANS

- Swiss faces hundreds of $million lawsuits, for refusal to deliver Allocated gold

- Saudi Arabia cuts new deal for Persian Gulf security protection, see Petro-Dollar

- Citigroup has high hidden exposure to Greek Govt debt default

- Chinese anger over reneged USGovt gold & silver lease, as part of the Most Favored Nation granted status, has motivated its extreme pursuit of precious metals

- Containers hold $300 to $500 billion in EuroNotes at Greek port warehouses

- Internet strides light years ahead of USGovt regulatory hounds at syndicate offices

GOLD & SILVER BREAKOUT IN ALL CURRENCIES

The great spring 2011 precious metals consolidation is coming to an end. In no way is the Quantitative Easing program coming to an end, otherwise known as hyper monetary inflation. Printed money is being abused to cover bank insolvency and to redeem toxic bank assets. The central banks are taking down the QE billboards. They will continue with their debt monetization in order to manage the financial system collapse in an orderly manner. As David Malpass adroitly said on Bloomberg Financial News, the debt monetization known as quantitative easing will quietly become an integral but hidden part of the USFed monetary policy. The central bank must find a way to cover the $200 billion in monthly USTreasury auctions, to roll over the obligated primary bond dealer inventory, and to lap up the mountain of toxic mortgage bonds that prevent an all-out cave-in of the bank balance sheets. The reality is that nothing has been fixed, nor attempted in solution. The grotesque insolvency of banks, households, and government is the marquee message. Without continued monetization, the system would collapse rapidly and disorderly. However, with continued monetization, with a QE chapter by another name or conducted behind the same curtains, the system will collapse in a gradual and orderly manner. The USFed has no more credibility. Witness the early stage of another uniformly applied global Gold bull market breakout.

The Gold price has hit record highs in the British Pound Sterling, where their banks are insolvent, their economy is in reverse, price inflation is ramping up, and their currency is facing grandiose debasement. The SterlingGold price smells monetary ruin. The global breakout is manifested first in the most broken non-American locations, since the spring ambush orchestrated in the COMEX has put huge pressure on foreign currencies. The Competing Currency War still leads the desperate USFed officials to slam foreign currencies and to place financial press attention on their declines.

The EuroGold price smells monetary ruin. The attention has been squarely on the Greek battle to avoid debt default. Every news story about the USEconomy faltering is following immediately by a story of Greek bailout impasse or Athens challenge to ingest suicidal austerity pills or riots on the Athens streets. The differentiation of EuroBonds with greatly varying bond yields has permitted the Euro to trade on speculative merit. The Greek default threat surely pushes down the Euro. But the prospect of a higher Euro Central Bank interest rate leaves speculators to buy the Euro, since proper pricing mechanisms are in place on the sovereign bond yields. The European investors are clearly flocking to Swiss banks on the paper investment side, but their pursuit of Gold is enormous. The Euro Monetary Union is running on fumes. The pain in Spain is hardly on the wane. The Gold price will rise and break out soon enough.

The YenGold price smells monetary ruin. The situation in Japan is terrible, complicated, and tragic. The advent of trade deficits will aggravate the outsized cumulative debt burden on the nation. The paradox is starting to show itself. Their trade deficits will force the national insurance firms and banks, even the Bank of Japan, to sell existing US$-based assets in a political compromise. They do not want to monetize more debts. They do not want to create worse federal budget deficits. They will compromise by selling foreign assets to finance the reconstruction and dislocation costs. The paradox will manifest itself with a rising Yen currency in the face of worsening deficits in every conceivable crevice. As their nation slides into a sea of red ink, the salt on the wounds coming in the form of price inflation, the Gold price will rise and break out soon enough.

Last to break out will be Gold in US$ terms. The Gold price smells monetary ruin on home turf, not to be deceived by any USFed head fakes. Perhaps a sudden awakening to the obvious continuation of QE2 and merge into QE3 could enable a Gold breakout in double quick fashion, ahead of other currencies. Much more stability is seen in the Gold price rise in US$ terms, as the destruction is more stable, the monetary ruin more understood, the federal budget debate more openly futile, and the national insolvency more publicized. The early May high of 1563 will easily be surpassed, all in time. The impetus might be QE163 or a liberated USGovt deficit from a raised debt limit or a failed USTreasury auction or a big US bank failure or a spike in mortgage rates or a plummet in housing prices or a longer parade than the current stream of miserable USEconomic data. The Gold price rose toward $1550 following the vacant FOMC meeting on Wednesday, where the main purpose was to put us to sleep.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Gold rush as sales surge predicted

From The China Daily:

From The China Daily:BEIJING - Gold's luster is continuing to attract rising domestic demand and China will continue to "outperform" other countries in private consumption of the precious metal, with sales growth remaining above 20 percent over the next two years, an industry expert said.

Gold rush as sales surge predicted

The amount individual buyers purchase as an investment is expected to surge two-fold annually, Zhang Bingnan, secretary-general of the China Gold Association, said.

And the government's gold reserves are "far from enough", and should be increased to fend off global financial risks, he said.

According to the China Gold Association, domestic gold sales grew 21.26 percent to 571.51 tons last year from 2009.

Since the international financial crisis China has led growth in gold sales worldwide.

This is set to continue in the coming years as the "average holding of gold by individuals is still too small and the nation's rapid economic growth will further stimulate consumption and investment", Zhang said.

"Demand for gold, mostly driven by investment, will grow at least 20 percent this year," he said.....read on

Greece, IMF & EU agree to 5 year austerity plan

From WSJ.com:

From WSJ.com:BRUSSELS—Greece has agreed to a five-year austerity package with the European Union and the International Monetary Fund that could clear the way for a new bailout loan if Greece's Parliament approves the measures, an official said late Thursday.

"We have a deal after the Greek government agreed to more spending cuts and some higher taxes," the official, who had direct knowledge of the talks, told Dow Jones Newswires.

The official said the deal was reached after Greek Finance Minister Evangelos Venizelos agreed to lower the minimum taxable income for Greek taxpayers to €8,000 ($11,500) from €12,000 previously.

The deal also depended on Greek agreement on a special crisis levy on all taxpayers, ranging between 1% and 5%, depending on income.....read on

Gold May Advance on Europe Debt Woes

From Bloomberg:

From Bloomberg:Gold may gain as concern about Europe’s debt woes and sustained record-low interest rates in the U.S. spur demand for the metal as an alternative investment, a survey found.

Twelve of 16 traders, investors and analysts surveyed by Bloomberg, or 75 percent, said bullion will rise next week. Two predicted lower prices and two were neutral. Gold for August delivery was down 1.3 percent for this week at $1,519.70 an ounce by 11 a.m. yesterday on the Comex in New York. It reached a record $1,577.40 on May 2.

European Central Bank President Jean-Claude Trichet this week said danger signals for financial stability in the euro area are flashing “red” as the debt crisis threatens to infect banks. Policy makers decided to keep the Federal Reserve’s balance sheet at a record to spur the economy after completing $600 billion of bond purchases this month and repeated they will keep borrowing costs low “for an extended period.”

Gold will be supported “due to continuing sovereign-debt and currency risk,” said Mark O’Byrne, executive director of brokerage GoldCore Ltd. in Dublin. The Fed’s “ultra-loose monetary policies and zero percent interest rates are to continue for the foreseeable future,” he said. “This is a continuing positive for gold prices.”.......read on

Gold Convertibility To Save The Euro?

From Forbes:

From Forbes:Professor Robert Mundell urges gold convertibility for the euro, the currency which he fathered, as well as for the dollar. This is a major step forward. Thought leaders are abandoning “old monetarism,” which was vainly fixated on quantity. Even its chief proponent, Milton Friedman, acknowledged old monetarism as unsuccessful in a 2003 interview with the Financial Times. An emerging “new monetarism” is quickly taking its place — one that focuses on the quality, not quantity, of money.

Empirical data suggest that the gold dollar represents the epitome of quality. As Forbes’ own Steve Forbes advised the presidential candidates last week, the “debate should be focused on what the best gold system is, not on whether we need to go back on one.”.....read on

Keiser Report: Greece Resistance Special

This time Max Keiser and co-host, Stacy Herbert, report on IMF dowgrades, zombie consumers and a financial circus. In the second half of the show, Max talks to Professor Steve Keen about the Greek debt crisis and Minsky's moment.

Thursday, June 23, 2011

'Illegal' Snatch: US wants to grab all data on European air passengers

Raiders of the Lost Server

From: RTAmerica | Jun 22, 2011

No fix for the US Economy

Bernanke Leaves Door Open to Further Easing

Federal Reserve Chairman Ben S. Bernanke left the door open to a fresh shot of monetary stimulus should the economic rebound he’s predicting fail to materialize.

The Fed would be “prepared to take additional action, obviously, if conditions warranted,” including the purchase of more Treasury securities, Bernanke said yesterday after U.S. central bankers met in Washington. The economy will probably overcome constraints from elevated energy prices and Japan- related disruptions to manufacturing, he said. Still, declining home prices, high unemployment and weaknesses in the financial system may restrain the recovery in the longer term, he said.

Policy makers in a statement yesterday acknowledged the slowdown even as they agreed to complete $600 billion in bond- buying as scheduled this month in the second round of so-called quantitative easing. While the outlook for employment and inflation is better than before the latest bond purchases, Bernanke said he’s not sure how long the economic headwinds will persist. Stocks fell in New York trading.....read on

Bullion Blows-Up Banksters

20 June 2011

There is, however, an even more fundamental antagonism which the paper-pushing "elites" feel toward precious metals: the simple act of holding bullion is effectively an involuntary "de-leveraging" of the endless $trillions in bankster Ponzi-schemes which have totally contaminated nearly all Western economies.

Readers should not confuse my title with the popular "take down JP Morgan" campaign spearheaded by a few so-called "silver vigilantes". When I talk about bankers being "blown up" by bullion, this is an entirely passive process. First of all, our purchasing of bullion (as has been often explained) is a defensive move to "insure" our dwindling wealth against the currency-dilution inflicted upon us by the excessive money-printing of the bankers. Secondly, the "harm" caused to the bankers by bullion is indirect, and entirely a function of their own excessive behavior.

Let me quickly cover the first premise by once again reviewing the monetary abomination known as "fractional reserve banking". In the typical, modern "fractional reserve system", each time we deposit a (paper) dollar with a bank (or invest it), our eternally greedy bankers are allowed to effectively print-up ten more dollars, loan them out into the economy (or "invest" them) - and thus that $1 dollar suddenly becomes $11, with the other $10 dollars being a windfall created (literally) out of thin air, which has neither been "earned", nor does it have anything at all "backing" its value.

This ten-to-one dilution of our currency - which is nothing less than (legal) systemic fraud - is precisely how the Federal Reserve has been able to reduce the value of the U.S. dollar by roughly 98% (over its 98-year existence). But even stealing at this rapacious rate was not enough to sate the greed of the 21st century Wall Street bankster.

They directed their spineless servants in Washington to change a vast number of rules (and eliminate even more "safeguards") allowing these banksters to increase that (already obscene) 10:1 leverage to an utterly insane level of greater than 30:1 - which turned the entire U.S. financial system (and most of its debt and equity markets) into a collection of hopelessly unstable Ponzi-schemes. This leverage-insanity has culminated in the creation of the banksters' private casino: the $1.5 quadrillion derivatives market - by itself more than twenty times bigger than the entire global economy.

Thus when a small minority of individuals engage in the "defensive" strategy of buying bullion, we are protecting ourselves in two ways. First of all, we are isolating our waning wealth in a form which the banksters cannot dilute/debauch with their money-printing. Secondly, we are accumulating this insurance against the inevitable financial collapse when the bankster Ponzi-schemes finally implode. There is, however, an indirect "virtuous circle" which is set in motion by the simple act of buying bullion, which (to the best of my knowledge) is not being discussed by other commentators - either in the mainstream media, or within this sector itself.

Let us back-up to the basic premise upon which fractional-reserve banking exists: we invest or deposit a dollar with a banker, and then they are legally allowed to dilute that dollar by anywhere from a factor of 10:1 or 30:1. However, each and every time that we take one of our dollars and invest it into precious metals, we are breaking that cycle of dilution (and currency-destruction).

As this purchasing of bullion increases, we thus began to weaken the cycle of serial currency-dilution, and effectively de-leverage our own financial systems. Note that this "involuntary de-leveraging" of Wall Street (in particular) has been made 100% necessary due to the complete failure of servile politicians and corrupt regulators to rein-in the 30:1 insanity of Wall Street. Indeed, after only a brief drop-off (when there were no "chumps" available to take their bets), all reports indicate that the Wall Street vampires are just as leveraged today as they were before they almost destroyed the global financial system the first time - except that this insane leverage is now concentrated in even fewer hands.

This means that as individuals accumulate bullion to personally insure and insulate their wealth from the fractional-reserve piracy of modern banking, that collectively our actions are insuring and insulating our entire economies against the inevitable economic carnage as the paper-bubbles collapse - including all of the worthless, fiat currencies themselves.

In fact, I only began to consciously explore this line of reasoning myself when I was admiring the brilliance of Hugo Salinas Price's movement to re-institute silver money as a "parallel currency" in Mexico. Critics of this scheme have argued that most of the silver money being created would quickly disappear: people would spend their paper money, and hang onto their (higher quality) silver money.

My rebuttal to that has been that this is the beauty of Salinas Price's proposal. Effectively, instead of Mexicans having paper "savings accounts", where they give their pesos to bankers - and then suffer the economic rape of currency-dilution - Mexicans would have "silver savings accounts", 100% immune to the monetary depravity of bankers. I then added to that by pointing out the cumulative effect of this: permanently reducing the percentage of our wealth which is under the control of bankers, and (simultaneously) permanently reducing our vulnerability (i.e. leverage) when these paper-pirates (yet again) destroy themselves (and our system) with their insatiable greed and reckless gambling.

The mainstream media have been programmed with their own rebuttal. They call such behavior "hoarding". This is nothing less than a perversion of semantics. In fact, for more than 4,000 years most of humanity has held their "savings" in the form of gold or silver, and billions of people do so today, primarily in Asian economies.

What has been "savings" for 4,000 years does not become "hoarding" simply because the mainstream media chooses to be an accomplice of the banksters in helping them steal our money through their fractional-reserve Ponzi-schemes.

This supplies ordinary citizens with yet one more motivation to insure a large percentage of their wealth by converting it to ("physical") gold or silver. Not only are we protecting ourselves individually, but collectively we are engaging in the "bank reform" which our cowardly and corrupt political leaders have failed to do.

This means that each and every time you hear some media talking-head parrot the words "hoarding silver", you can immediately translate that to mean "insuring our financial system". The fact that it will ultimately help to "blow up the banksters" (as a consequence of their own greed) is merely a fringe benefit.

Jeff Nielson