4 February 2011

We have spoken often about what will be the first real domino to fall in causing a chain reaction ending up in massive global political and financial change. Often we follow our predictions with a statement something along the lines of, "but, in actuality, the defining primary event will likely come from somewhere that no one expects".

I think it's safe to say that no one expected TEOTMSAWKI (The End Of The Monetary System As We Know It) would begin in Tunisia!

It appears that people, including Americans and westerners, are willing to put up with all manners of oppression, taxation and economic stagnation until it reaches the point where they are so impoverished that they cannot even afford to eat.

It is, at that point, that they finally fight back against their oppressors as was the case in Tunisia - and which set off a chain reaction of protests and uprisings in Yemen and Egypt along with other related uprisings in Algeria, Lebanon and Jordan.

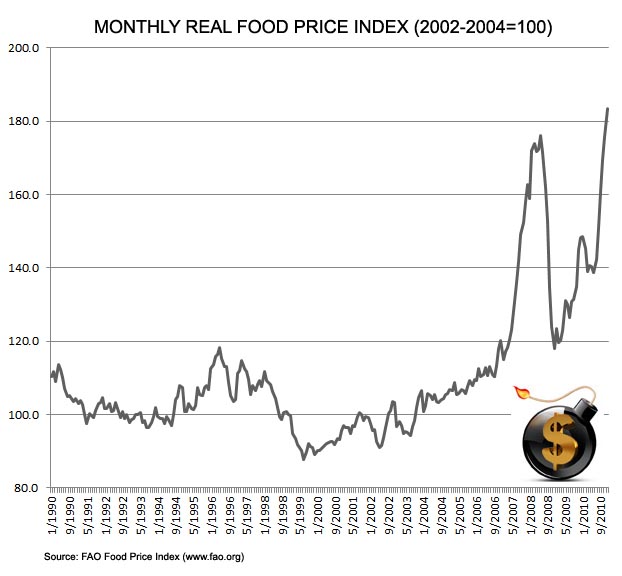

It is still far too early to begin to make any conclusions about these new developments caused partially by rising food prices in the Arab world but there are three very possible outcomes that all threaten the tenuous US dollar based financial system:

- The worst case scenario: Many of the current governments in the Arab world are overthrown, giving way to the democratically elected devils they didn't know, who delve the entire Middle East into war. This has any number of potential outcomes including nuclear war. It could also drag the US military into hostilities which would further increase the pace of US dollar monetary inflation (needed to pay for further war) which would further hasten the dollar hyperinflation.

- The wave of Arab uprisings moves into Saudi Arabia and the other Middle East/Arab major oil producers causing an overthrow of American friendly governments resulting in an end to the "oil for Treasury bonds" agreement. This could result in the oil region not reinvesting its profits into Treasury bonds causing further weakness in bonds, and prompting the Federal Reserve to contemplate QE3 in order to prevent rates from rising too dramatically, or to the 11.1% mark where the US government may become technically insolvent as interest rates overtake all tax income (minus social security payments).

- Rising food prices and potential for government collapse in other key US Treasury bond holding states such as China, Japan and other Asian countries result in those countries selling Treasury Bonds and dollars in order to increase the value of their currency in order to reduce the prices of imported food items to keep their populations at bay inducing the same results as in (2) above.

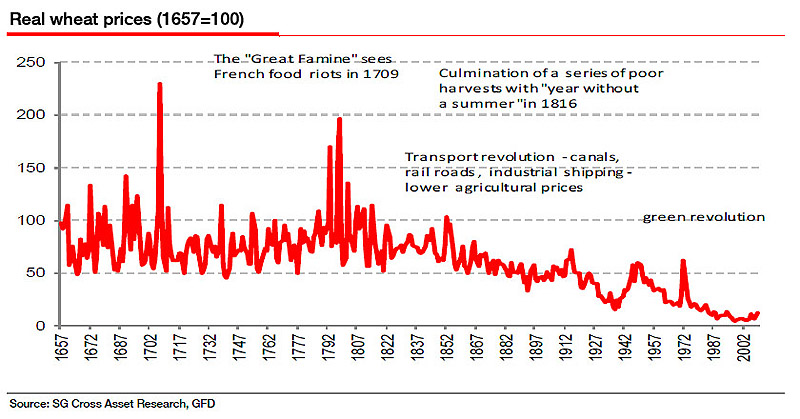

Most mainstream media accounts of rising food prices usually state that the "growing world population" is responsible for the rise in food prices but there is no statistical evidence that growing population correlates to rising food prices.

In fact, food prices have gone down in price, when adjusted for inflation as per the chart above, over the long term even as populations increased as technological advances enable producers to produce more food at less expense.

The reason food prices are now rising all around the world is because central banks have been inflating the money supply in every country in the world at very high levels.

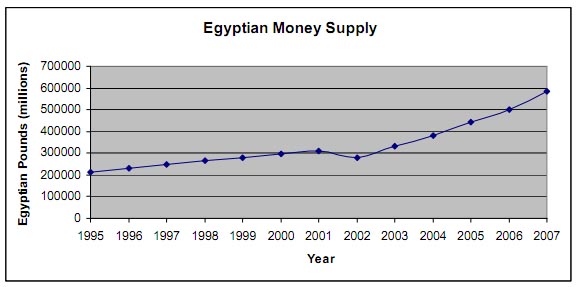

It is difficult to get Egyptian money supply figures, especially since internet access has been cut off by the Egyptian Government making access to the Central Bank of Egypt's website (www.cbe.org.eg ) impossible but we found this report from Lindsay Vacek from the University of Reno (see report here) who had done a country study of the Egyptian money supply up to 2007.

Ms. Vacek's report shows that the Egyptian money supply grew from 200 billion pounds to 600 billion pounds from 1995 to 2007 - a threefold increase in just over a decade. A recent news article (www.tradearabia.com/news/eco_191183.html) also stated that the Central Bank of Egypt reported total money supply was at 961 billion pounds in 2010. An increase of over 50% since 2007.

This is massive monetary inflation and is, undoubtedly, the main reason why many Egyptians are having trouble even being able to pay for food. Inflation hurts the poorest people the most because poor people generally don't have assets and in an inflationary environment those who own real assets (gold, stocks, real estate) see the rise of the price of their assets offset the rise in prices.

The Dollar Vigilante released a Special Report on "How to Own Gold and Silver" this week to subscribers in which we detail how to own gold & silver bullion safely and securely (Subscribe today to receive this Special Report - 90 day 100% Money Back Guarantee on Subscriptions).The government and financial establishment on November 9th made it clear that they are declaring war on the precious metals. They are about to find out that this time they are not up against one or two brothers, but the brotherhood of all of humanity who is turning its back on this failed centrally planned financial system and returning to an honest, free-market money.

No comments:

Post a Comment